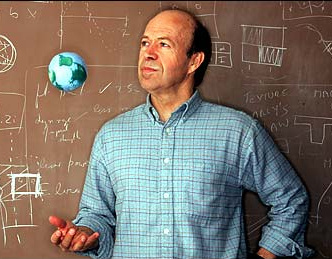

James Hansen On the Easter Bunny Myth of Renewables and His Plan for a Carbon Tax

In a recent essay posted online, NASA scientist James Hansen explains what he calls the “Easter Bunny” fantasy that we can adequately address climate change by providing subsidies for renewable energy sources and by increasing energy efficiency. As Hansen details, given current projections, subsidies alone have little chance of expanding wind and solar, yet environmentalists and many liberal political leaders continue to spread this gospel.

Hansen’s solution is a carbon tax, an approach he has advocated for some time, but an idea that people both on the left, the right, and in the middle appear to be slowing converging on. The details and compromises necessary to make a carbon tax work politically still need to be addressed. I suspect that a carbon tax as Hansen suggests could only gain Republican support if it were paired with a lowering of income tax rates. In that case, Dems would want to use the carbon tax to pay for government programs, rather than the direct rebate that Hansen favors.

Here’s Hansen’s discussion on how what he calls the Easter Bunny myth of renewables continues to hinder progress on climate change:.

Many well-meaning people proceed under the illusion that ‘soft’ renewable energies will replace fossil fuels if the government tries harder and provides more subsidies. Meanwhile, governments speak greenwash while allowing pursuit of fossil fuels with increasingly destructive technologies (hydrofracking, mountaintop removal, longwall mining, drilling in the deepest ocean, the Arctic and other pristine environments) and development of unconventional fossil fuels.

It will be a tragedy if environmentalists allow the illusion of ‘soft’ energies to postpone demand for real solution of the energy, climate and national security problems. Solar power is just a small part of the solution. Subsidies yielding even its present tiny contribution may be unsustainable.

Victor and Yanosek discuss ineffectual U.S. policies to promote green energies and green jobs in the current issue of Foreign Affairs. They conclude that the policies do not promote technologies that can compete with fossil fuels without subsidies. Victor and Yanosek suggest incentives for innovative technologies, including advanced nuclear power. Bill Gates is so distressed by their rational pusillanimous U.S. energy policy that he is investing a piece of his personal fortune to help develop a specific 4th generation nuclear technology….

…The main conclusion [on nuclear] is to keep an open mind. China and India will increase nuclear power use;they must if they are to phase out coal over the next few decades. It behooves us to be objective.

Recently I received a mailing on the climate crisis from a large environmental organization. Their request, letters and e-mails to Congress and the President, mentioned only renewable energies (specifically wind and solar power). Such a request offends nobody, and it is worthless….

Below is an excerpt of Hansen making the case for a carbon tax with revenues returned directly to the public. I like the idea but several questions come to mind, particularly the need to fund innovation and development of competitive renewable energy sources.

First, where does funding for innovation in soft renewables come from? As Roger Pielke and others suggest, why not put some of the carbon tax revenues directly into an ambitious NIH-scale R&D program on energy innovation?

Second, in the past when Americans have received Federal tax refunds, my understanding is that they haven’t put the money into savings, but instead immediately put the money into more consumption. If Americans are receiving $2-3,000 a year in returns from a carbon tax, does research suggest they would spend that money on more consumption i.e. leading to increased energy use? It’s a question worth examining and I would like to hear readers’ thoughts.

Third, a direct rebate to Americans does serve a strong social justice and equity function, a dimension that was sorely missing from the cap and trade debate and a major weakness of that policy approach. If energy costs are going to rise via a tax, the people most affected will be those of lower socio-economic means. The $2-3,000 in cash back could go a long way to helping them cope with the additional costs.

As long as fossil fuels are cheap, they will be burned. But fossil fuels are cheap only because they do not pay their costs to society. Costs include direct and indirect subsidies, human health costs from air and water pollution, and climate change impacts on current and future generations.The public can appreciate that a rising price must be placed on fossil fuel emissions, if we are to phase out our addiction to fossil fuels. A carbon fee must be placed across-the-board on all fossil fuels in proportion to carbon emissions. The fee should be collected from fossil fuel companies at the first domestic sale (at domestic mine or port of entry).

No international exchange of funds is required. The fee would be collected in the nation burning the fuel, and the money would be distributed within the country.The carbon fee must rise to substantial levels to provide the incentives needed to encourage lifestyle changes, investments in clean energies and energy efficiency, and technology innovations.The public and businesses must realize that the fee will rise over time.The fee, to be effective, perforce must have a notable effect on the price-at-the-pump, utility bills, and almost all aspects of economic life.

The public will not allow the fee to rise to levels that are needed to phase out fossil fuels if the disposition of the money is determined by the government, banks, and economists, the people responsible for the current economic mess. Disposition of the money collected from fossil fuel companies is thus the most critical matter. You can be certain that politicians and economists will come up with all sorts of suggestions about how they will cleverly use the money (investments in renewable energies, reduction of other taxes, etc.). Do not let them get away with it.

The fee will only reach required levels if the money is going to the public. Let the motto be “100 percent or fight!”The money collected from fossil fuel companies should be distributed electronically each month to bank accounts or debit cards of all legal residents. My suggestion is that each legal adult resident get an equal share, with families getting an added half share per child up to a maximum of two such half shares per family.

For example, the carbon fee proposed by Congressman John Larson ($15/ton of CO2 the first year, growing $10 each year) would be $115/ton after 10 years. Such a rate would add about $1per gallon to the price of gasoline. However, it would also yield an annual dividend of $2000-$3000 per legal adult resident, $6000-9000 per family with two or more children. Economic models show that this fee would yield a 30% reduction of carbon emissions at the end of the 10years, and we would be well on our way to phasing out our fossil fuel addiction by mid-century.

Such a growing fee on carbon emissions is the only way that fossil fuels can be phased out. It can be called a carbon tax, but there is no net tax if the money is distributed to the public. Such distribution is necessary, so that the public has the wherewithal to make changes needed to deal with rising fossil fuel prices. Sixty percent of the public would receive more in their dividend than they pay in increased fuel prices. The public would be encouraged to make changes in their energy choices and energy use, in order to stay on the positive side of the ledger.Such a simple, honest, transparent system is essential for public acceptance. The public will never accept the gimmicky cap-and-trade system, which inherently brings big banks into the matter and encourages bribes to the fossil fuel industry. Nor can cap-and-trade ever become global – China and India will never accept caps on their economies, but they have many reasons to put a price on carbon emissions to avoid fossil fuel addiction, solve local pollution problems,and to be in a leadership position in a global move toward clean energies.

Below you can watch Hansen making the case for a carbon tax and for nuclear energy from past Big Think interviews.

See also:

Video Interview with Climate Fix Author Roger Pielke Jr.