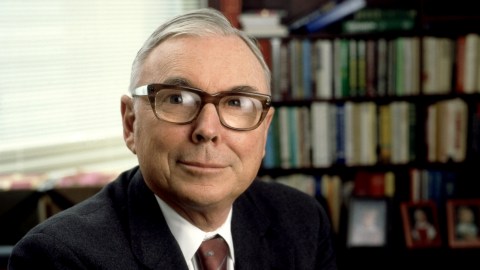

Can you solve Charles Munger’s microeconomic puzzles?

- In this extract from a 2003 lecture, Charles Munger lays out a couple of real-world microeconomic problems and guides you through the solutions.

- The answers to the problems unlock a “mental algorithm” for smart investing.

- By bearing in mind four key factors, investors can increase their chances of a “lollapalooza result.”

Let me demonstrate the power of microeconomics by solving two microeconomic problems, one simple and one a little harder.

The first problem is this: Berkshire Hathaway just opened a furniture and appliance store in Kansas City, Kansas. At the time Berkshire opened it, the largest-selling furniture and appliance store in the world was another Berkshire Hathaway store selling $350 million worth of goods per year. The new store in a strange city opened up selling at the rate of more than $500 million a year. From the day it opened, the 3,200 spaces in the parking lot were full. The women had to wait outside the ladies’ restroom because the architects didn’t understand biology. It’s hugely successful.

Well, I’ve given you the problem. Now, tell me what explains the runaway success of this new furniture and appliance store that is outselling everything else in the world.

Let me do it for you. Is this a low-priced store or a high-priced store? It’s not going to have runaway success in a strange city as a high-priced store. That would take time. Number two, if it’s moving $500 million worth of furniture through it, it’s one hell of a big store, furniture being as bulky as it is. And what does a big store do? It provides a big selection. So what could this possibly be except a low-priced store with a big selection?

But you may wonder, why wasn’t it done before, preventing its being done first now? Again, the answer just pops into your head: It costs a fortune to open a store this big, so nobody’s done it before. So you quickly know the answer. With a few basic concepts, these microeconomic problems that seem hard can be solved much as you put a hot knife through butter. I like such easy ways of thought that are very remunerative. And I suggest that you people should also learn to do microeconomics better.

Now I’ll give you a harder problem. There’s a tire store chain in the Northwest that has slowly succeeded over 50 years, the Les Schwab tire store chain. It just ground ahead.

It started competing with the stores that were owned by the big tire companies that made all the tires, the Goodyears and so forth. And, of course, the manufacturers favored their own stores. Their “tied stores” had a big cost advantage. Later, Les Schwab rose in competition with the huge price discounters like Costco and Sam’s Club and before that Sears, Roebuck and so forth. And yet, here is Schwab now, with hundreds of millions of dollars in sales. And here’s Les Schwab in his 80s, with no education, having done the whole thing.

How did he do it? I don’t see a whole lot of people looking like a light bulb has come on. Well, let’s think about it with some microeconomic fluency.

Is there some wave that Schwab could have caught? The minute you ask the question, the answer pops in. The Japanese had a zero position in tires, and they got big. So this guy must have ridden that wave some in the early times. Then, the slow following success has to have some other causes. And what probably happened here, obviously, is this guy did one hell of a lot of things right. And among the things that he must have done right is he must have harnessed what [economist N. Gregory] Mankiw calls the superpower of incentives. He must have a very clever incentive structure driving his people. And a clever personnel selection system, etc. And he must be pretty good at advertising. Which he is. He’s an artist.

So, he had to get a wave in the Japanese tire invasion, the Japanese being as successful as they were. And then a talented fanatic had to get a hell of a lot of things right and keep them right with clever systems. Again, not that hard of an answer. But what else would be a likely cause of the peculiar success?

We hire business school graduates, and they’re no better at these problems than you were. Maybe that’s the reason we hire so few of them.

Well, how did I solve those problems? Obviously, I was using a simple search engine in my mind to go through checklist-style, and I was using some rough algorithms that work pretty well in a great many complex systems, and those algorithms run something like this:

Extreme success is likely to be caused by some combination of the following factors:

- Extreme maximization or minimization of one or two variables. Example, Costco or our furniture and appliance store.

- Adding success factors so that a bigger combination drives success, often in nonlinear fashion, as one is reminded by the concept of breakpoint and the concept of critical mass in physics. Often results are not linear. You get a little bit more mass and you get a lollapalooza result. And of course, I’ve been searching for lollapalooza results all my life, so I’m very interested in models that explain their occurrence.

- An extreme of good performance over many factors. Example, Toyota or Les Schwab.

- Catching and riding some sort of big wave. Example, Oracle. By the way, I cited Oracle before I knew that the Oracle CFO [Jeff Henley] was a big part of the proceedings here today.

Generally, I recommend and use in problem-solving cut-to-the quick algorithms, and I find you have to use them both forward and backward.

Let me give you an example. I irritate my family by giving them little puzzles, and one of the puzzles that I gave my family not very long ago was when I said, “There’s an activity in America with one-on-one contests and a national championship. The same person won the championship on two occasions about 65 years apart. Now,” I said, “name the activity.”

Again, I don’t see a lot of light bulbs going on. And in my family, not a lot of light bulbs were flashing. But I have a physicist son who has been trained more in the type of thinking I like. And he immediately got the right answer, and here’s the way he reasoned: It can’t be anything requiring a lot of hand-eye coordination. Nobody 85 years of age is going to win a national billiards tournament, much less a national tennis tournament. It just can’t be. Then he figured it couldn’t be chess, which this physicist plays very well, because it’s too hard. The complexity of the system and the stamina required are too great. But that led into checkers. And he thought, “Aha! There’s a game where vast experience might guide you to be the best even though you’re 85 years of age.”

Anyway, I recommend that sort of mental puzzle-solving to all of you, flipping one’s thinking both backward and forward. And I recommend that academic economics get better at very small-scale microeconomics as demonstrated here.

From: Academic Economics: Strengths and Faults after Considering Interdisciplinary Needs. Herb Kay Undergraduate Lecture, University of California, Santa Barbara Economics Department, October 3, 2003