Master the Greek concepts of “kairos” and “chronos” to improve business timing

- Life is a combination of routine (chronos) and unexpected moments of opportunity (kairos). Business is no different.

- Mastering the balance between following a steady plan and seizing opportunities is crucial for successful mergers and acquisitions.

- There are practical ways every business leader can harness chronos and kairos to great effect.

Most days run themselves. There’s a clockwork monotony to how they operate — the same things, in the same sequence, to the same endpoint. Life potters along. Very occasionally, though, there will come a moment. It might be an invitation, an opportunity, or a gift. Or it might be a rejection, a setback, or an accident. These moments are what wrench life from the single-track chug toward some new direction. They punctuate and explode. Life is what happens between these poles — a pendulum swinging between monotony and adventure.

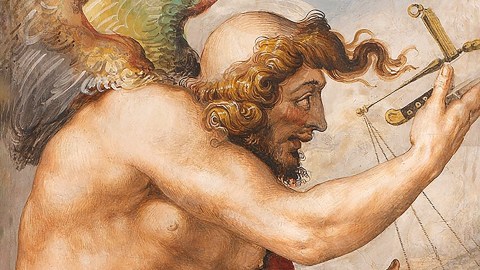

As is so often the case, the Greeks wrote about this long before anyone else. They had two words to describe each: chronos and kairos. Chronos is the ticking of the clock; it’s the forward, zombie steps of just getting on with life. Kairos, though, is a sudden, opportune moment that comes barging into your life and demands attention. It’s the time for something.

Imagine you are at the fifth hole of your local minigolf course. You stand, holding your rusty putter, and watch the swinging arms of the windmill that block the way. It spins round, and round, and round. This is chronos — time, going on. You take a breath, draw back your arm, and whack. This is the time to hit the ball. This is the single, unique moment to avoid the spinning blades. That moment is kairos.

As goes life, so goes business. Every successful business has known when to use chronos and when to jump at kairos. Success is the combination of hard graft and long hours, as well as an intuitive readiness to pounce. According to new research from a global team of economists, mastering this juggling act is essential to effective mergers and acquisitions (M&As).

M&As are stressful, complicated, and often very expensive. The task of managers is to align not only products and services but also the byzantine networks of organizational hierarchies and workplace cultures. The period known as post-merger integration “can be highly stressful for employees, with layoffs, departmental consolidations, and long-standing feuds between colleagues being common.” How, then, can an appreciation of kairos and chronos ease this transition period?

Kairotic switches

Thomas et al. took a close look at one particular merger between two non-profit organizations: Capla and Vincenzo. Capla was the smaller of the two and had been struggling to keep revenue up since 2014. “Vincenzo was the stronger of the two partners, injecting the much-needed capital to ensure the survival of Capla.” It was a merger with more than an undertone of acquisition.

What the research team discovered was that “kairotic switches may be a key managerial competence.” A “kairotic switch” is the capacity and willingness to abandon a plan when events get in the way. A plan is essential; you cannot ad hoc and freestyle an M&A. Companies need to reassure stakeholders and establish market confidence in the M&A process.

Equally true, though, is that a rigid plan, unbending to situations and variables, will prove to be ineffective and likely very costly. We can draw out two examples from the paper.

One of the first things Vincenzo wanted to do was reorganize the sales department. The Head of Sales opposed this, so management decided on a lengthy and gradual reorganization to ease the transition. Halfway through that time, the Head of Sales unexpectedly resigned. A commitment to chronos would have kept the agreed time frame in place. Instead, the kairotic switch was flicked: An opportunity presented itself, and a door opened. Management took it.

Often, kairotic switches are triggered by a resignation, a departure, or a change in roles. At other times, it might be a cultural and psychological shift within the company. For example, at the start of the Capla-Vincenzo merger, there was a self-described “civil war” between certain departments. Senior management didn’t want to intervene too quickly, in case they upset staff motivation and morale, and so decided to take a chronos-approach of “wait and see.” The kairotic switch came when certain individuals in the civil war “behaved publicly in a manner deemed to be inappropriate.” Their reputation and legitimacy were damaged, and so management took the opportunity to speed ahead by combining the warring departments.

How to balance chronos and kairos

The lessons from the Capla-Vincenzo merger were learned in hindsight — so how can we apply the findings of this research to our day-to-day lives and businesses? How can we balance chronos with kairotic switches? Here are three takeaway points:

Be flexible. Do not dogmatically stick to a time frame devised in the calm, comfy chairs of a board meeting. The reality of complicated business decisions will often run away from you. While speed is important in post-merger integration, it is equally important to ensure that the integration process is effective and sustainable in the long run. One of the most famous examples of a successful merger is Disney and Pixar. From day one, Bob Iger, the new CEO of Disney, wanted to acquire Pixar. The Disney board agreed, and they established a time frame — chronos. But there was one kairos-shaped issue: Steve Jobs. The process was paused. The timeframe was flexible. Space was given for Iger and Jobs to work through their differences, and the result has been one of the most lucrative, blockbuster industries of all time.

Consider the whole timeframe. Choosing the right time and moment doesn’t only apply to the process of M&I but also to when you start M&I in the first place. For example, the merger between Amazon and Whole Foods. Amazon strategically timed the acquisition to capitalize on the growing demand for organic and healthy food options. By acquiring Whole Foods at the right moment, Amazon was able to integrate the brand into its ecosystem and rapidly expand its grocery delivery services, ultimately increasing its market share in the food industry.

Embrace change. Markets don’t like volatility. But mergers are inherently disruptive. Accept this friction by being willing to try new things, experiment with different approaches, or take calculated risks in order to drive growth and create value — all of which could benefit from a basic understanding of chronos and kairos. On Big Think+, Cassandra Worthy talks us through how to harness the power and energy of change; and how to use the anxiety of change to innovate and move forward. Over the course of eight videos, she teaches us not to fear change, but to use it.