Richard Dawkins’s Tree Metaphor: Why Free Markets Are So Inefficient

“Competition creates efficiency,” is preached as if it were a law of nature. But nature itself teaches a different lesson. Biological competition can create foolish costs, and collective doom. “Darwin’s Wedge” shows why and reminds us of the point of being human. Our competitions, and the myopic logic of free markets, needn’t be dumb as trees.

“Tree trunks are standing monuments to futile competition” says Richard Dawkins. He uses the “Forest of Friendship” to show just how unintelligent evolution and natural competition can be. A forest canopy is like “an aerial meadow…raised on stilts…gathering solar energy.” Yet much of that “energy is ‘wasted’ by being fed straight into the stilts” which only raise “the ‘meadow’ high in the air” gathering “the same harvest…as it would—at far lower cost—if it were” on the ground. No tree can afford to ignore the height competition. But if somehow the trees could agree to limit their heights, each could save energy and the forest as a whole would be more efficient.

What can market lovers learn from nature’s competitions? Systems of self-interested agents, myopically responding to local incentives, can evolve unfruitful competitions. Once a way of competing arises, opting out can be suicide. If we let markets imitate trees (and most of nature) in practicing unfettered mindless competition, we miss the point of being human, which is to use reason and foresight to coordinate better outcomes.

A $62 billion monument to “futile competition” exists in healthcare. Drug companies spend 24% of revenue on marketing versus 13% on R&D. Prescription decisions should be based on objective medical criteria and public data. Spending so much on armies of salespeople is tree-trunk logic: No company can risk not playing the game. However, a neutral body empowered to enforce agreed limits could change the game and achieve marketing disarmament. Whatever information salespeople provide could be put online for a tiny fraction of today’s $74,000 per doctor (and reduce nonmedical distortions).

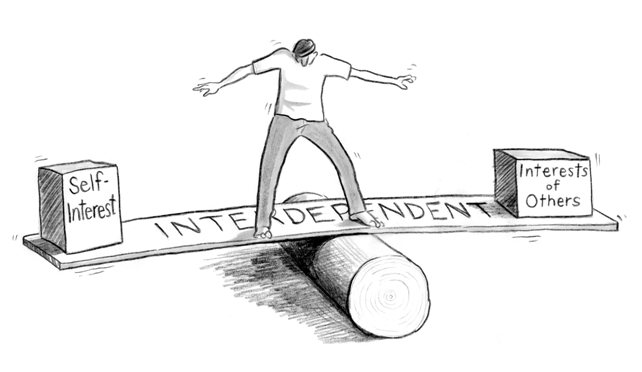

Robert Frank coined “Darwin’s Wedge” to describe situations where individual incentives diverge from collective goals (sometimes even risking collective doom). Darwin’s Wedge applies to an entire class of problems wherein supposedly locally rational decisions aggregate badly (see the market fallacy of composition). These include the tragedy of the commons, Prisoner’s Dilemma games, and Nash equilibria. In them using myopic self-maximizing logic ends badly for each and all. But tackled as coordinated action problems, with monitoring and enforcement, outcomes can be guided to everybody’s benefit. Free markets aren’t suited to such simultaneous complex cross-agent coordinated change.

Competition’s benefits arise from the constraints it creates. Intelligent constraints, and creative responses to them, can work better than what emerges from mindless “natural” competition. The human trick isn’t self-organizing, it’s other-organizing. We’ve coordinated team survival for 10,000 generations. Our choices now are either to let the power of markets be dumb as trees, or to guide their competitions for better outcomes.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.