Seeing No End to Crisis in Sight, Soros Shorts World

George Soros doesn’t see anything that even remotely resembles his idea of what’s needed to jumpstart economic recovery and so still can’t see the bottom. There’s perhaps no one in the world at spotting the opportunities that emerge when political orthodoxy conflict with financial reality than Soros–so much. After the jump, a look into the SEC filings of his Soros Management, which provide a window into his vision of the future (well, due to filing cycles, as he saw the future last quarter).

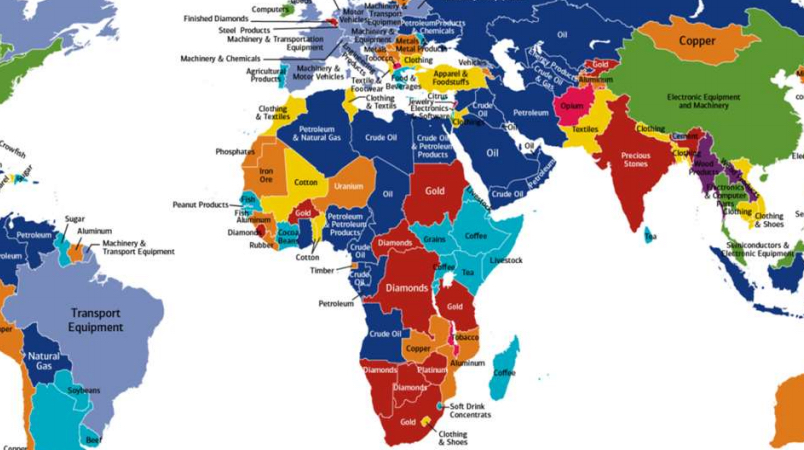

Some of Soros’s notable positions include stakes in Best Buy and Merrill Lynch–positions that foresaw Circuit City’s demise amidst deteriorating and Merrill’s comparatively rich takeover by Bank of America. His two largest holdings traded on U.S. exchanges, however, are in Potash, a Canadian crop nutrients producers, and Petrobras, Brazil’s national oil company. Imagine a looming surge in oil prices in the face of diminishing supply and a rush to cultivate agricultural alternatives –George Soros has.