If You’re So Smart, Why Aren’t You Rich?

Editor’s Note: Over the next 12 days, Big Think will be running excerpts from all the lessons that make up our first online course, Great Big Ideas. During this period, we are offering discounted subscriptions to Big Think readers. You can now subscribe and gift this course for $99. Please sign up and then subscribe using the coupon code THINK to get the discount.

What’s the Big Idea?

Warren Buffet is fond of saying that the first rule of investing is never lose money and rule number two is never forget rule number one. William Ackman takes this lesson as a point of departure for his Floating University lecture entitled “If You’re So Smart, Why Aren’t You Rich?”

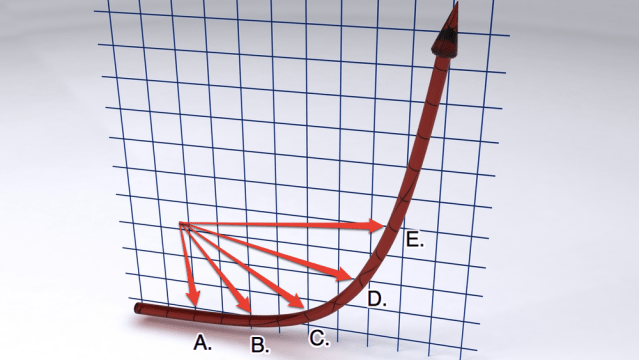

Ackman asks how can you avoid loses and earn an attractive return over time? Ackman’s answer is that you don’t want to be jumping from one company to the next. Instead, Ackman says, pick a company that you can own forever. In other words, if the stock market were to close for 10 years, you’d be perfectly happy with this investment. Two examples of these types of companies that Ackman offers are Coca Cola and McDonald’s. These are companies, according to Ackman, are easy to understand, they’re not complicated, have long-term track records, demonstrate an attractive profit, and can grow over time.

Watch William Ackman here:

What’s the Significance?

William Ackman asks what are the key things to look for in a business that lasts forever. First off, he says you should look at businesses that sell a product or service that people need, which is unique, and which people are willing to pay a premium for.

According to Ackman, another good example of this is the candy business. While people will buy generic versions of certain products, they tend to prefer a Hershey bar over the Walmart version or the Kmart version.

Why is this important? You don’t want to invest in a business that someone else can replicate and then sell at a better price.

Image courtesy of Shutterstock.