Chicago may become one of the first U.S. cities to implement a universal basic income program

Chicago may become one of the first U.S. cities to implement a universal basic income program (UBI).

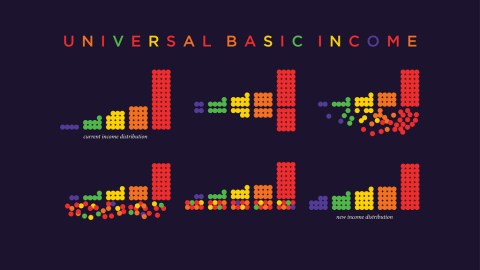

The proposal, introduced by Chicago Alderman Ameya Pawar, would create a small-scale UBI experiment that gives 1,000 families $500 per month with no strings attached, and would also change the Earned Income Tax Credit for participating families to give them monthly payments instead of a lump sum. At least several dozen lawmakers have endorsed the proposal so far.

My legislation calling for the creation of a Chicago #UniversalBasicIncome pilot has 36 co-sponsors! On to the Commitee on Workforce Development and Audit. Committee chair @40thWard is also a sponsor. More soon! #UBIpic.twitter.com/W7D5Hbx31E

— Ameya Pawar (@Ameya_Pawar_IL) June 27, 2018

Pawar said UBI is not only a way to ensure people still get paid as automation displaces their jobs, but that it’s also a safeguard against the inevitable sociopolitical strife that would follow.

“From a race and class perspective, just know that 66 percent of long-haul truck drivers are middle-aged white men,” he told The Intercept. “So if you put them out of work without any investment in new jobs or in a social support system so that they transition from their job to another job, these race and class and geographical divides are going to grow.”

On a national level, support for UBI seems split. A survey from Northeastern University and Gallup showed in February that about 48 percent of Americans would support a UBI program, 46 percent of supporters would pay higher personal taxes to support one, and 80 percent of supporters say companies should pay higher taxes to fund it.

Support for UBI seems to differ among political groups. In the February survey, about 65 percent of Democrats voiced support for UBI while only 28 percent of Republicans did. Independents were in the middle.

But is UBI a feasible solution to the looming threats of automation? After all, opponents argue the main effect of giving people free money would be that they start working less.

“It is reasonable to expect an unconditional cash transfer, such as a universal income, to decrease employment,” economist Damon Jones, who’s studied the effects of the Alaska Permanent Fund Dividend, which provides citizens of Alaska with an annual cash dividend, told Futurity.

In a paper published earlier this year, Jones and fellow economist Ioana Marinescu found that unconditional cash transfers in Alaska had no negative effects on employment, and actually increased part-time work.

“A key concern with a universal basic income is that it could discourage people from working,” Jones said. “But our research shows that the possible reductions in employment seem to be offset by increases in spending that in turn increase the demand for more workers.”

Pawar said that providing families with an income floor would enable them to make better financial decisions and prepare for emergencies.

“Nearly 70 percent of Americans don’t have $1,000 in the bank for an emergency,” Pawar told The Intercept. “UBI could be an incredible benefit for people who are working and are having a tough time making ends meet or putting food on the table at the end of the month. … It’s time to start thinking about direct cash transfers to people so that they can start making plans about how they’re going to get by.”

He also argued that big tech companies—many of which are led by figures who’ve endorsed UBI, like Elon Musk, Mark Zuckerberg and Sam Altman—should pay higher taxes to fund UBI programs.

“My response to Amazon, and Tesla, and Ford, and Uber … we need to start having a conversation about automation and a regulatory framework so that if jobs simply go away, what are we going to do with the workforce? … If [those companies are] reticent to pay their fair share in taxes and still want tax incentives and at the same time automate jobs, what do you think is going to happen?” Pawar told The Intercept. “These divisions are going to grow and, in many ways, we’re sitting on a powder keg.”