Debt-to-GDP ratio: No country owes more than Japan

- Japan has the world’s highest debt-to-GDP ratio, which is why it is at the center of this debt wheel.

- The U.S. has the world’s highest debt in absolute terms but is doing a lot better than Japan in relative terms.

- National debts seem unrelated to the strength of economies. So what’s so bad about a big national debt?

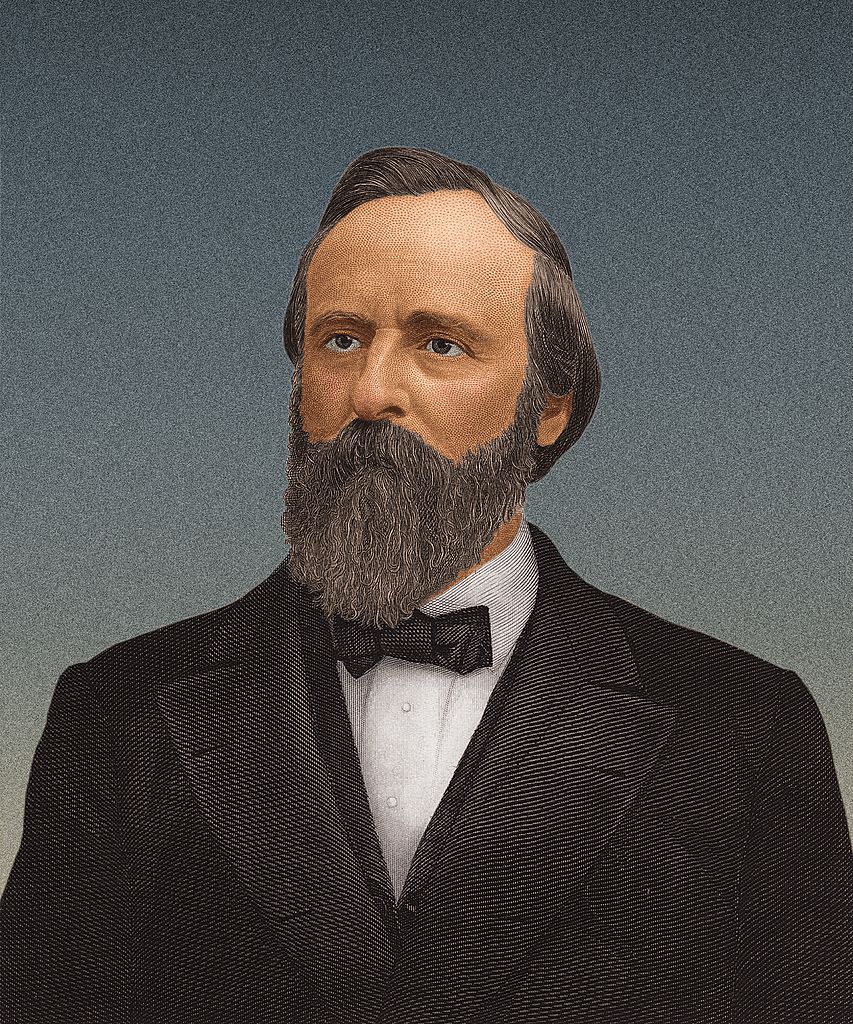

Rutherford B. Hayes knew a thing or two about debt. As the 19th President of the United States, he spent much of his single term (1877-81) dealing with the massive financial hangover left by the Civil War a decade earlier, when national debt had exploded by a phenomenal 4,000%. And as the result of some over-ambitious real estate investments, Hayes had some personal knowledge of debt as well.

Neither experience was a happy one. On July 13, 1879, about halfway through his presidency, he lamented in his diary: “Let every man, every corporation, and especially every village, town, and city, every country and state, get out of debt and keep out of debt. It is the debtor that is ruined by hard times.”

U.S. national debt: $30 trillion

That visceral aversion clearly has not rubbed off on Hayes’ successors. The U.S. national debt currently stands at just over $30 trillion dollars. Many economists argue that the more relevant figure is the debt held by the public, which is a much more modest $23.5 trillion. Either way, the U.S. has the dubious distinction of possessing the world’s largest national debt, in absolute terms. To make that figure more comprehendible, it’s an IOU just over $90,000 per person.

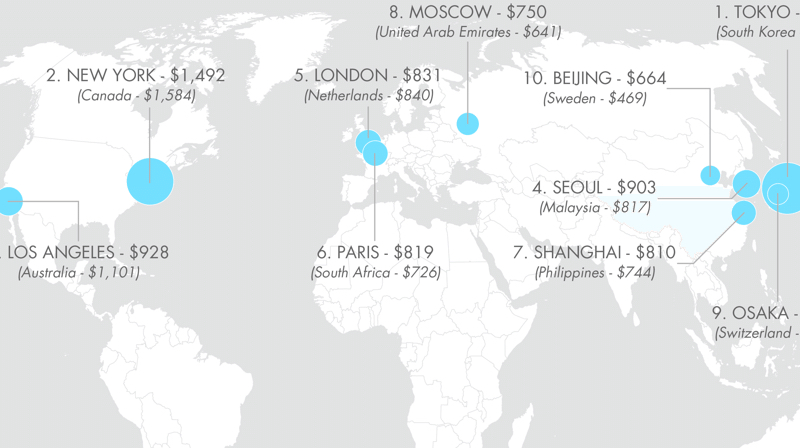

There are a few other ways to dice that onion. The standard measurement for the size of national debt is to express it as a percentage of the gross domestic product (GDP), i.e., the market value of all products and services generated by a country in a year. That’s what this infographic does. Arranged in eight circles (just one less than in Dante’s Hell), it ranks countries by their debt-to-GDP ratio. One of the first things we notice is that debt does not discriminate. Both developed and developing countries intermingle indiscriminately on either end of the scale, from the almost debt-free outer rings to the debt-ridden middle of the map.

But the very center, the middle circle, quite clearly belongs to just one country: Japan. The third-largest economy in the world (nominal GDP of just over $5 trillion in 2020) has a debt-to-GDP ratio of 256%. That means that Japan’s national debt is more than two and a half times its total annual economic output. That’s a very long line of Toyotas.

Japan, Sudan, and Greece: the 200% Club

In 2010, Japan became the first country to move beyond the 200% mark. No other country has racked up a debt that high, relatively speaking at least, but Japan has since been followed by two other countries across that symbolic threshold: Sudan (209.9%) and Greece (206.7%).

The rest of the second circle (138%-210%) is completed by a trio of smaller developing economies (Cape Verde, Suriname, and Barbados) and a major developing one: Italy (154.8%), which has the ninth-largest economy in the world, representing about 2.4% of global GDP.

Fourteen countries fill out the third circle (109%-138%), including some of the largest economies in the world: Canada (109.9%), France (115.8%), Spain (120.2%), and the United States (133.4%), whose debt-to-GDP ratio, according to this map, is just below that of Mozambique. As per the U.S. Debt Clock, America’s debt-to-GDP ratio is just 128%. Still, it’s the same ballpark: the country owes its creditors roughly 1.3 times all the goods and services produced in the U.S. in a year.

The fourth circle (83%-109%) contains 24 countries, including the last of the G7 members, Britain (108.5%), as well as the first batch of 15 countries with a debt ratio below 100% GDP. They include mature economies like Austria (84.2%) and emerging ones like Ghana (83.5%).

Germany and Gabon, debt buddies

As the circles widen, ever more countries have ever lower debt ratios, from Pakistan (83.4%) to Panama (62.2%) in the fifth circle, and from Armenia (62.2%) to the Central African Republic (46.5%) in the sixth. The outer circle is made up of countries with a debt-to-GDP ratio of 46.1% (the Pacific island nation of Vanuatu) all the way down to a minute 2.1% (Hong Kong — if it still counts as being separately administered). China, by the way, is in the fifth circle, at 68.9%.

So, with debt seemingly unrelated to the economic fortunes of countries — Germany and Gabon are debt buddies, both with a debt-to-GDP ratio around 72% — what’s the big deal with having a big national debt?

While debts for nations and individuals are not quite the same, one thing remains true: debts tend to accumulate, and they must be paid. If debts rise, so does the risk that countries default on their debt, resulting in all kinds of financial turmoil, including very real panic and hardship for its citizens.

The debt question is especially relevant in Covid-19 times. The pandemic will be over long before the debts will be repaid, which were racked up by governments to keep wages paid, companies afloat, and economies from collapsing.

Plenty of economists are unfazed by debt and, in fact, see deficit spending (that is, spending more than you earn and making up the difference by running up a debt) as a good way to kickstart economic growth. Rutherford B. Hayes would most probably disagree and have a snide thing or two to say about them in his diary.

Strange Maps #1130

Got a strange map? Let me know at strangemaps@gmail.com.

Follow Strange Maps on Twitter and Facebook.