Updating Hayek: Can ‘The Market’ Prioritize Well?

This is diablog 9 between David Sloan Wilson (DSW) and me (JB).

1) JB: [Friedrich] Hayek, half a century ago, added key evolutionary ideas to economics, which you say need major updates.

2) DSW: Hayek had two way-ahead-of-his-time insights. First, that economic systems have a distributed intelligence that cannot be located in any individual. Second, that this intelligence evolved by cultural group selection. Contemporary science — complex systems and multilevel evolution — validate those claims. But Hayek fans are mistaken to believe that his insights mean markets should be unregulated.

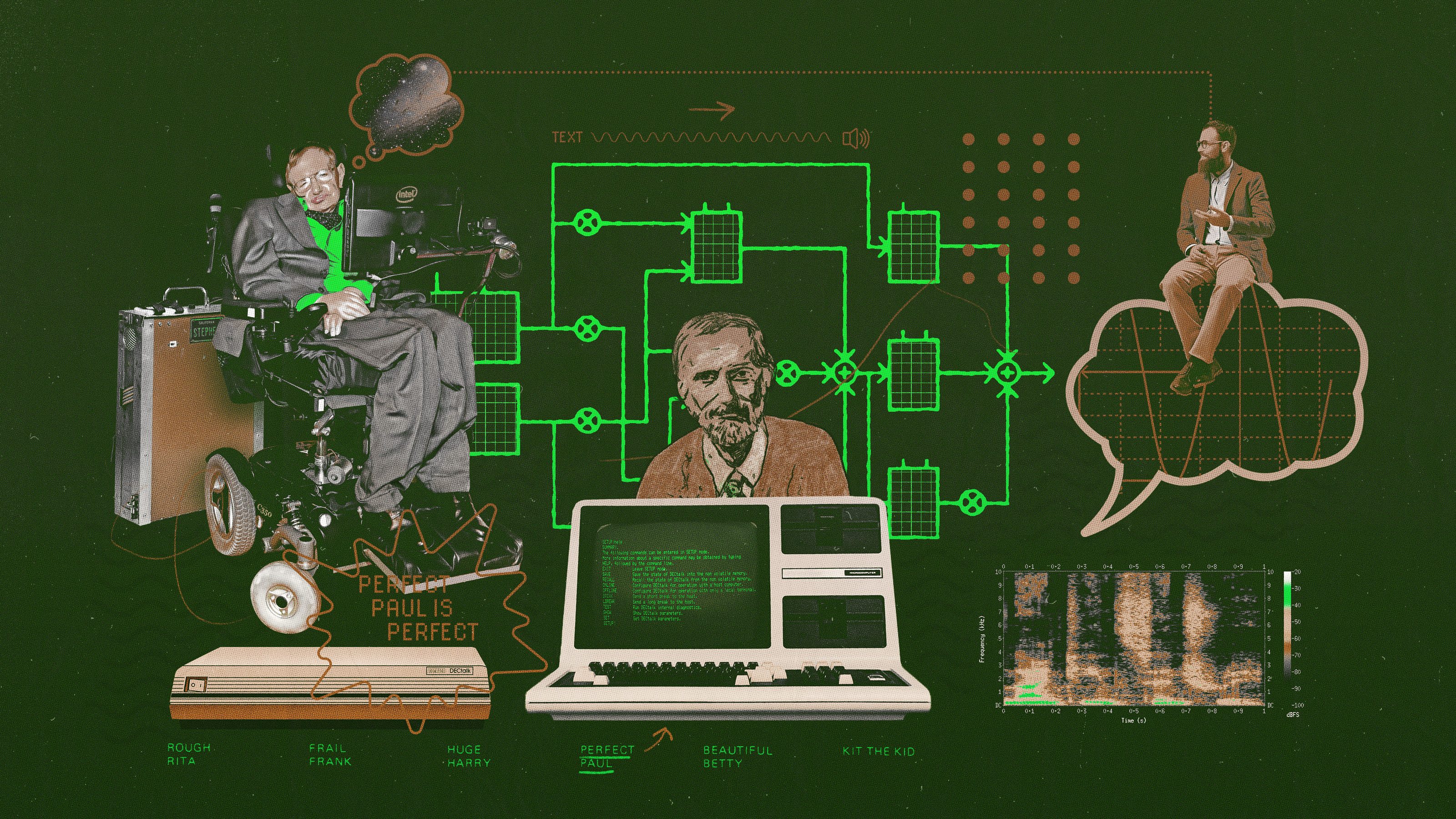

3: JB: OK, markets use evolved distributed intelligence to compute resource allocations. So let’s add more computer science, and ideas about biological computation and signaling.

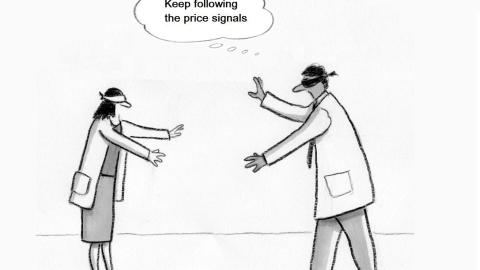

4. JB: Hayek’s right that no “central planner” can know what’s distributed among people in markets. But computer scientists have studied distributed processing’s limits. Many tasks can’t be efficiently distributed. Most still need central coordination. Aren’t market computations similarly limited?

5. JB: Plus, free markets “compute” using only one kind of data, in only one way. Their distributed intelligence is hardwired reflexively to local price signals. That’s like having no central nervous system.

6. JB: Central nervous systems evolved specifically to enable non-reflex, non-distributed responses and decisions that prioritize for the organism as a whole. But “the markets” decide musical toilets take priority over basic needs. Their distributed intelligence invests in lifestyle drugs (here’s an example currently in the news) but ignores failing antibiotics. And a mindless markets mindset suggests we can’t save the planet unless that’s profitable.

7. JB: Imagine an organism that used only one price-like signal for all its internal coordination. Human blood-sugar allocation needs eight separately varying regulatory signals.

8. DSW: Comparing a healthy economy to an organism shows that Hayek was both right and wrong. Organisms regulate a mind-boggling number of processes to stay alive. Every one of them is a distributed process — even the central nervous system (viewed closely enough). Every one was produced by natural selection: The distributed processes that work better winnowed from the much larger number that didn’t. And distributed “invisible hand” processes aren’t all good.

9) DSW: We can draw two implications for economics. First, distributed processes that work often include both the public and private sector [both central and distributed elements]. It’s stupid to think the private sector works well and the public sector just gets in the way (see economist Mariana Mazzucato’s explanation). Second, more winnowing is required for economic processes to adapt to current and future conditions. Natural selection can’t work fast enough, so it will have to be policy selection informed by evolution and complexity science.

10: JB: Effective market regulation should heed biology’s regulatory lessons. Economies, like complex organisms, need distributed reflexes and a central nervous system. They need more than one price-like signal to prioritize and regulate for the whole, and to manage systemic risks. That doesn’t happen automatically. Take, for example, the 2008 crash, in which [Alan] Greenspan confessed: Self-regulation failed).

11. JB: Centrally guided and regulated doesn’t mean “centrally planned” (Hayek and [Adam] Smith both understood regulation’s role). It’s more like steering a ship, and adjusting for shifting conditions.

This is the last post in this diablog series.

Earlier diablogs covered: (1) evolution’s score keeping (relative fitness), (2) its built-in team aspects, (3) its self-destructive competitions, (4) its blind logic, (5) how division of labor complicates, (6) why economics needs a version of evolution’s “inclusive fitness,” (7) why whatever your politics, you need needism, and (8) why biology shows relying on the “invisible hand” is a monumental mistake.

PS – Hat tip to Robert Kadar who provided input.