The Top 6 Game-Changing Hedge Funds

The amount of money hedge funds make is only surpassed by the amount of secrecy surrounding how they make it. To pull back the curtain on these financial wizards, Big Think asked Sebastian Mallaby, author of “More Money Than God: Hedge Funds and the Making of a New Elite,” to describe the six hedge funds that have fundamentally changed the industry:

1. A. W. JONES

This first game-changing hedge fund has to be the one that began the game, and that was the one set up by Alfred Winslow Jones in 1949, which is a lot earlier than most people think there were hedge funds. Jones, who had run anti-Nazi missions undercover in the early 1930s, set up his first “hedged fund” and carried on in the same clandestine manner. He raised $100,000, partly from himself and partly from his friends, and began to invest it. He didn’t register with the Securities and Exchange Commission, or any other regulator, and didn’t advertise his fund publicly.

The second thing Jones did was to incentivize both himself and his team of portfolio managers by keeping one-fifth of the profit on the investments in the fund. This was partly a scheme to be paid in a tax efficient manner, because you could be paid at the capital gains rate, which especially in the 1960s was much lower than the income tax rate. It also created an incentive for the hedge fund managers to push for new ways to invest and to beat the market consensus.

This combination of low profile, incentive fees, hedging, and leverage has characterized a lot of hedge funds ever since.

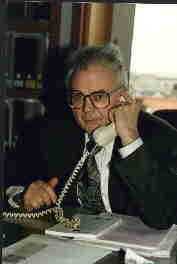

2. SOROS FUND MANAGEMENT

George Soros set up his fund in the late 1960s, focusing on equities. By the early 1980s he had discovered a bigger and better game, which was that currencies, which had been fixed together at the time he started his fund, were now oscillating excitedly.

Soros became a specialist in what became known as macro trading. He made his first killing in 1985 when he correctly jumped on the Plaza Accord, which was an agreement among the five leading economies to have the dollar move down and the yen move up. He made a lot of money on that because he could see that the U.S. economy couldn’t sustain a strong dollar forever.

Equally in 1992 he made another huge amount of money by understanding that the exchange rate system in Europe was unsustainable, and that Italy and Britain would be forced out of it. He bet that the lira and the pound would collapse and they duly did, not least because of his aggressive selling. He emerged a household name as the scourge of governments by the amazing fact that a small hedge fund company with perhaps a dozen employees could overwhelm the Bank of England or the Bank of Italy.

3. PAULSON & CO.

One example of understanding something big about an economy that can’t be sustained is the hedge fund trader John Paulson. He understood that there was just too much cheap credit in the U.S. economy around 2005-2006, that it couldn’t be cheap forever and therefore that it would correct. He figured out the best way to bet on that correction was to be short sub-prime mortgage debt. That is how John Paulson became famous in 2007 by making four billion dollars, personally, in one year by betting the sub-prime bubble would pop.

John Paulson is now betting that the huge amounts of debt that governments are issuing all over the rich world will lead eventually to inflation. And therefore he is buying gold because it is the traditional safe-haven against inflation when all currencies lose credibility.

4. LONG-TERM CAPITAL MANAGEMENT

Long-Term Capital Management (LTCM) was a hedge fund set up in 1994 with the help of two Nobel prize winning economists and other extremely smart, quantitative economists. It did incredibly well until the middle of 1998, then suddenly lost all its money and had to be rescued following a meeting at the New York Federal Reserve. Although the New York Fed didn’t put any money into the rescue, and so tax payers were not on the hook, it was a Fed orchestrated rescue which signaled the Fed was worried that if LTCM had not been recapitalized by bankers there could have been disruption to the whole financial system.

LTCM became sort of the poster child for how risky hedge funds can be. And the truth is, that is a good lesson to have learned. But at the same time, LTCM was an outlier. Its leverage, its borrowing, was twenty-five times its equity. That is about ten times more than the average hedge fund, which has leverage of about two or three times.

5. FARALLON CAPITAL

There are two interesting things about Farallon Capital. The first is whom it raised money from. It was the first hedge fund to receive money from a university endowment, which was the Yale College endowment. Yale made so much money from its bet on Farallon that it created a trend whereby more and more college endowments, and then retirement systems, began to see that investing in hedge funds could be a good idea. By 2010 about only one-third of the money in hedge funds comes from rich individuals, with the other two-thirds coming from endowments, retirement systems and other institutions.

Second, Farallon pioneered a style of hedge fund management called event-driven investing, which involves betting on circumstances where a major event—for example, a takeover bid or a bankruptcy—has scrambled the normal belief that market prices are efficient. The hedge fund’s skill is to analyze the event. For instance, if it’s a takeover, the hedge fund would figure out whether there are anti-trust concerns that might keep a merger from going through.

That style of event-driven investing was really a fringe type of activity in the 1980s, but by the late 1990s had spawned this special class of event-driven hedge funds that became extremely big extremely quickly. Going into the future, event-driven funds will continue to be a major force because they make money in a way that is not correlated with other other kinds of investment styles.

6. RENAISSANCE TECHNOLOGIES

Renaissance Technologies is best known for running a fund called Medallion, which is the most successful hedge fund of all time. It started to make huge money in 1990 and for twenty years hasn’t stopped. It hasn’t had a single down year, and most years it has been up more than 50%. The way it achieves this is through very high-order mathematics.

The people who made the early breakthroughs in this fund began from the mathematics of code breaking. They basically had the approach if you can do it with enemy code, you can do it with financial markets, which are mainly efficient and mainly random, but there are particular nonlinear patterns in the way that markets react to a perturbation such as the announcement of a new employment number.

There isn’t a repeated pattern, because that would be way too obvious, but there might be in slightly more than 50% of the cases a pattern that comes up. If you can see that and you can write down the algorithm to describe it, you won’t make money on every trade, but you’ll make money on more than half the trades.

Looking into the future, there is no particular reason to expect that they will stop generating returns. There is one catch, which is they can’t make this Medallion fund big. It has got to be limited to something like six billion dollars or so because you are trading short term effects. If you put too much money on the bet in a short time, your own money will force the price away from you.

Still, $6 billion is a lot, and the founder of Renaissance Technologies, James Simons, reportedly earns well over $1 billion most years. That means he earns more in one year than the famous J.P. Morgan accumulated in an entire lifetime, even after adjusting for inflation. Hence the title of my history of hedge funds: “More Money Than God.”

For more thoughts from Sebastian Mallaby on Big Think, check out our recent post Why Hedge Funds Are Safe—And Why Women May Be Their Future.