Where Amazon, Facebook and Google buy some of their best ideas

It’s been said that “Imitation is the sincerest form of flattery,” and that may at one time have been true. But in today’s tech culture, it might be more accurate to suggest “Acquisition is the sincerest form of flattery.” In the startup era, there’s big money to be made for a tiny company with a brilliant idea. Google alone has spent $30.7 billion buying out smaller companies at a rate of 11 per year, according to IG, a U.K. investment firm. And they’re not anywhere near being the most acquisitive tech company—that honor here would go to Cisco, which has spent $83 billion. HP, Microsoft, Intel, and IBM have also spent more than Google.

Note: There is a lot of info packed into the images in this post—click or touch an image for a full-size, interactive view.

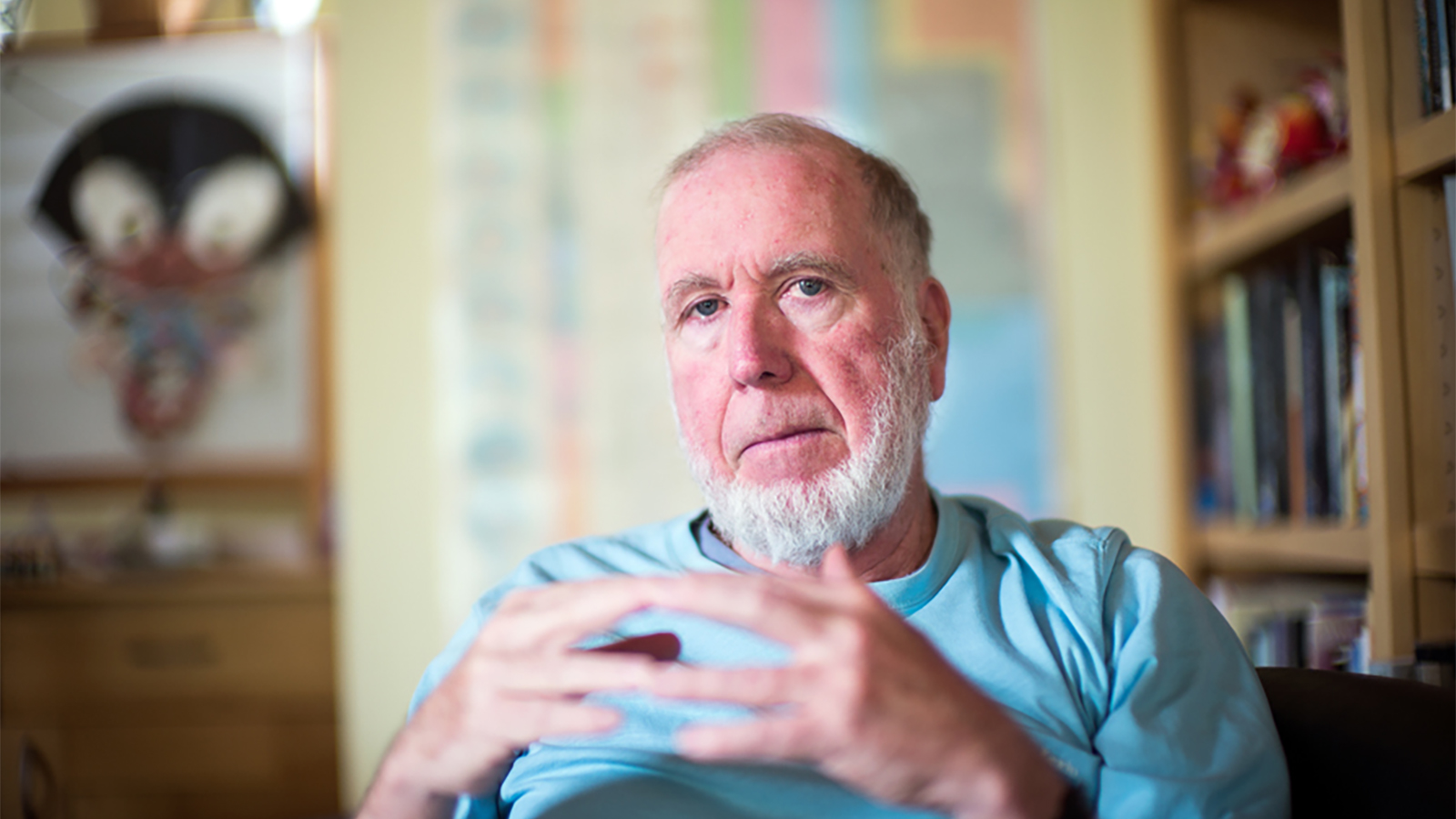

How much the companies spend on acquisitions. Click to zoom. (Credit: IG)

IG has built a fascinating interactive visualization about all this called Acquisitive Tech. It tracks the purchases of 10 of the big tech firms—click or touch the + sign to reveal any that aren’t currently being displayed. If you’re at all into computer-based tech, you’ll have a great time poking around it.

Great ideas

If someone is brilliant—and fortunate enough—to parlay an innovative idea into success, they may find themselves atop a pile of money with little idea as to how they might remain there. Very few people have the ability to keep coming up with earth-shaking ideas. There’s Michelangelo, there’s Ben Franklin—it’s a short list. Think about your musical favorites: Once they’ve said what they have to say musically during their first few years in the spotlight, you’ve pretty much heard it, and things can get a bit too predictable to be any fun.

It makes sense, really, when you consider how few truly absolutely-out-of-nowhere ideas there are. In reality, an innovative idea is a fresh synthesis of its creators’ experiences, and each of us only has one past to draw from. By voraciously consuming new experiences a creative person may be able to do it again, but it’s hard and rare.

The people who run the large tech companies know this. A number of their CEOs—Google’s Larry Page, Amazon’s Jeff Bezos, Facebook’s Mark Zuckerberg among them—began with their own brilliant idea. These leaders generally do try to increase the odds of producing new breakthroughs by hiring other brilliant people to dream them up, and these people may make their own meaningful contributions. But it’s hard to control where lightning strikes—yes, Mr. Franklin, unless you have a lightning rod—and it can strike anywhere.

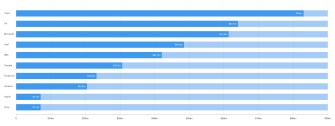

How many purchases each company makes a year. Click to zoom. (Credit: IG)

A part of the art of being successful in tech is in keeping an eye on the horizon for such flashes of brilliance and being smart enough to spot the ones that can be capitalized upon and to know how to do it.

It’s no wonder there are so many startups out there to be bought, too: All it takes is a great idea, enough investment capital to launch it into public view, and then there’s a chance you could be rich should a big tech firm come shopping. This happens all the time, for example, with Nest Labs when Google bought the company for $3.2 billion in 2014. How much eventual financial upside there is can be a matter of rumor more than fact since startup purchase prices are rarely disclosed. To find a price tag of some of the companies in IG’s visualizations, or even what they do, requires some Googling of your own.

A.I. and machine learning startup purchases. Click to zoom. (Credit: IG)

Best game in Silicon Valley

That bit of mystery is what’s the most fun about seeing all these acquisitions, because even when you learn what a startup’s business was, it may not be at all obvious what value the larger company saw in it. Plus, the big boys are not always right: That Nest purchase? Um…

All of these tech giants are, after all, planning many moves down the chessboard, and their acquisitions often have to do with initiatives they’re nowhere near making public and may wind up never making public. Want to know what they’re up to? Look at what they’re buying and see if it offers some clue. And if you can figure it out, you may be as smart as the people running these companies.