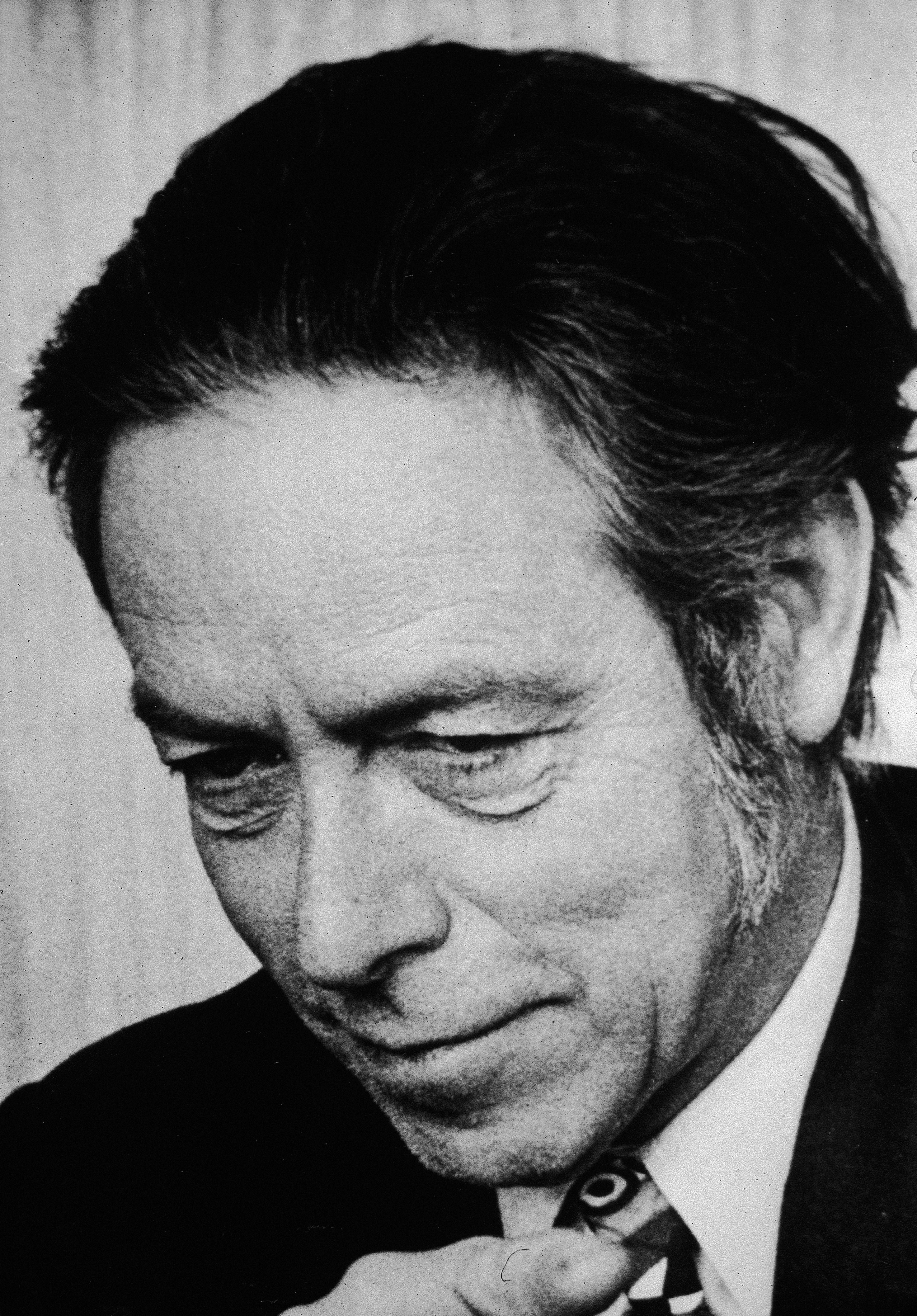

Thomas Cooley defends Alan Greenspan, invoking Bob Woodward’s book The Maestro.

Question: Is Alan Greenspan to blame for the era of cheap money?

Thomas Cooley: No, I don't agree. People have been attacking Alan Greenspan pretty vigorously in the press lately and laying the whole blame for the credit crisis at his feet. So what I think about that is two things, one is that in the 1990s Alan Greenspan could do no wrong, he was hailed as the Maestro. Bob Woodward wrote a book call The Maestro and Bob Woodward said, you know, at the end of the Wizard of Oz when the man comes out from behind the curtain, when the wizard shows his face, we feel a little bit underwhelmed, but with Alan Greenspan, we always feel safe or something like that. I think they gave him too much credit for monetary policies when times were good because when times are good, when the economy is strong, monetary policy is really, sort of, boring.But what Alan Greenspan did and realized, was he just got out of the way and let productivity drive the economy. But where the real test of a central banker comes is when the usual rule books don't apply, when you're not just making monetary policy for ordinary times, but when you're subject to some fundamental strains on the financial system. And Greenspan faced several such incidences. The first was October of 1987, when the stock market collapsed. Another one was the Asian financial crisis in the 1990s, the Russian bond default in the 1990s. There was the collapse of long-term capital management in the 1990s. There was 9/11. And in all those cases, Alan Greenspan understood what the role of the Central Bank was to provide enough liquidity and keep the financial system functioning. And because he knew enough–- because he did that in those instances, he came out of those crises with his reputation enhanced. And that was his real genius, was to know what to do when the system was in a severe crisis. And for all those reasons, the shocks that were felt then, didn't become the new normal. So the charge against him is–– lately has been that he kept interest rates too low for too long. But when he left office, there wasn't a lot of inflation. So there's a real question about what do you mean by interest rates being too low for too long. It was not the case that he caused the housing bubble, you know. Having interest rates low doesn't mean you have to make unwise loans. Nor did he encourage people to assume that prices could only go up and up. So I think he's a convenient scapegoat. That's a long winded answer.

Recorded: 3/21/08