Is the new Silk Road–the flow of oil and gas from the Middle East to Asia, and Asian goods flowing to the Persian Gulf–a new foundation for the world economy or a marriage of convenience?

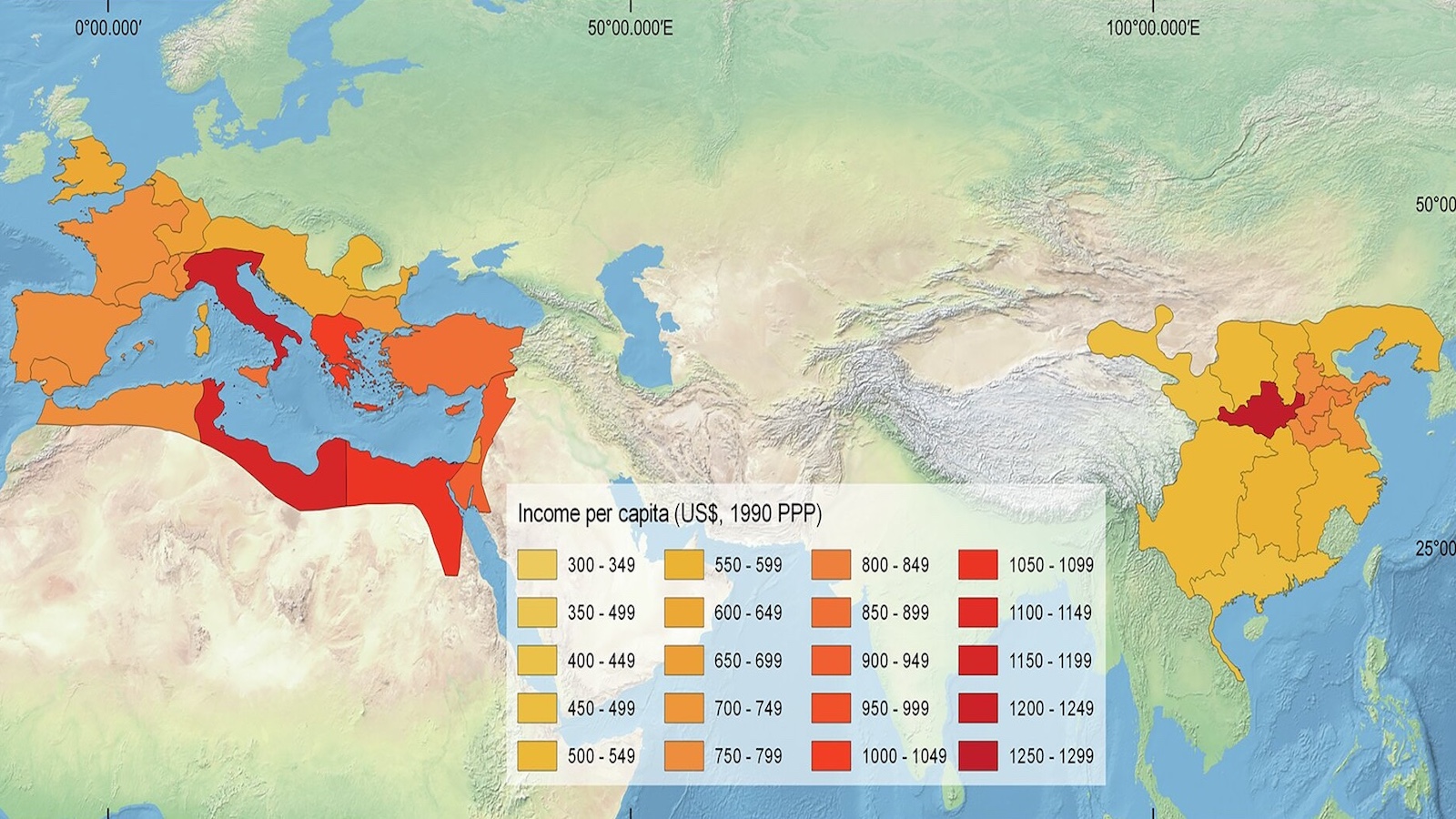

Parag Khanna: Welcome to the Global Roundtable. This series focuses on the future of economic competition. I’m Parang Khanna, joined by a distinguished panel including: Dambisa Moyo, Daniel Altman and Anand Giridharadas. Today’s topic is the new maritime Silk Road. And what we mean by that is despite the financial crisis, we have emerging market regions trading evermore with each other and even becoming engines of global economic growth into the future. We have maps that show that the resource rich Persian Gulf countries are increasingly selling their oil, not to the west, but across the Indian Ocean to the east, hence this new maritime silk road. What does it mean though? Can it really be the core driver of the global economy moving forward?

Dambisa Moyo: Well, I think fundamentally, we shouldn’t be surprised at that. I mean, these are the economies, the emerging economies south, south traders as you will, is really backed up by these large populations of people who are trying to improve their economic living standards. You know, it’s not just the Middle East and China; it’s the fact that China has about seven percent arable land, means that she’s always going to be looking for places that have more arable lands to finance or to provide food stuffs. The fact that Africa is the largest placed with the untilled arable land left on earth means it’s a natural symbiosis, a natural relationship that should emerge there. I mean, is it a long term strategy? I think we don’t know because this is… these are depleting resources. So the question is, how much of this can continue over the long term?

Daniel Altman: Look, there’s no doubt that countries like China and even countries like Saudi Arabia need lots of resources to feed their people and feed their factories, but I think we’re at risk of a new kind of colonialism developing here which isn’t at the end of a barrel of a gun, but rather at the end of a billion dollar check. And it has some of the same risks. I think that it’s going to cause instability. I think in the long term it creates more risks than it gets rid of for these countries even though they’re doing trade, it’s the leaders who are making the deals, not the people.

Parag Khanna: So you’re saying comparative advantage is what is connoted by this term, new silk road, yet at the same time, it’s actually very mercantile in nature?

Daniel Altman: I think there’s some really coercive relationships that are developing and you only have to look at China’s influence over the foreign policy of some of the countries it does business with to see a new set of client-states developing.

Anand Giridharadas: I put it in a slightly different context, which is, I think to Dambisa’s point earlier, this is about the restoration of normalcy in a way. These are countries having relationships with each other that are not mediated by the West. And it’s going to continue and I think this is one of the questions that the west has to think about how can it still be relevant? Ten years ago, 20 years ago, maybe still today, a Korean company wanted to buy a Venezuelan company. It would probably still use New York investment bankers. We’re probably moving into a world where they’ll use Korean or Venezuelan investment bankers.

Daniel Altman: Well bringing ****…

Anand Giridharadas: And with shipping and with any other thing is the west even going to be in the middle of all these transactions among countries that are outside of the west?

Parag Khanna: In this 21st century **** actually you have Latin America and Africa as participants in growing share, in fact, of trade and exports more than in any other period of history. So in that sense is the unmitigated good thing, isn’t it?

Dambisa Moyo: Oh, I think it’s a missed trick by developed countries. I mean, if you think about the last 50 years, Africa’s proximity and historical context has absolutely been with Europe and the United States, but their approach in dealing with the economic challenges that Africa faces in particular has been one of handing out aid, not developing economies, not building a long term relationship around agriculture and so on. And they’re going to pay for that now. It’s not just Africa, the fact that Brazil and Chile now has China as their largest trading partner means the Monroe Doctrine is certainly something of the past.

Parag Khanna: But then, how do we make the countries on the receiving end of this check that may be masking a gun, how do you make them equal participants?

Anand Giridharadas: Well, we can’t make it happen from outside, it really has to come from inside. These countries, if they’re more democratic and more Ameriticratic we’ll be able to have a better say in their economic futures. But that growth, which is creating the south/south trade, is really a salubrious thing for the west as well because it’s creating more economic power in these parts of the world that can be consumer markets for the United States and Europe in the future.

Parag Khanna: These marriages of convenience are really going to continue into the foreseeable future. You mentioned China has an arable land shortage while Africa has a huge amount of agricultural productive potential, growing consumer markets which require energy in Asia, and of course energy supply in the Middle East, raw materials from Latin America going to the other markets, so… but where might this breakdown is one question that I think we need to ask?

Dambisa Moyo: Resource constraints, absolutely. The fact that we’ve got nine billion people planned for 2050 means that arable land, issues around water, issues around energy, issues around minerals absolutely are going to be front and center. And this is where, again, I think the west, led by the United States really has an important role in keeping the innovation and cutting edge in fresh because we will need to figure out a solution to provide for all of this.

Parag Khanna: So we have more than just one silk road, we have many silk roads in the future, but that doesn’t mean that we are not all on the same planet and have to face resource constraints. So, this is really an intimate issue for the future of the global economy and global competition. Thanks for joining us, more on that and other topics at BigThink.com.