This Is How Bad Credit Can Double The Cost Of Your Next Car

And the one “sucker’s question” you must never answer, even if the salesperson asks it.

For a majority of American adults, a car is a necessity of daily life. From commuting to work to running errands and much more — unless you live in a city where everything is in walking distance or you have a superb system of public transit — there’s no getting around needing a car. The big problem so many of us have, though, is that they’re incredibly expensive to buy. Sure, you can get an old clunker, but you’ll pay for it in repairs and in terms of all the things you missed or were late for due to unreliability. For most people, buying a new car is a part of the American dream. But at an average price of $36,270, a new car isn’t something most of us can just pay for up front. You have to finance it. And that’s where bad credit can double the cost of your next car.

Good credit is good news. The best thing about good credit is it means you’ll get a low interest rate when you buy a car. With outstanding credit, many dealerships will give you rates as low as 1.99% for terms 5 years (60 months) or under, or 2.99% for terms that last up to 7 years (84 months). Some will allow you to go even longer at slightly higher rates, like each additional year at an additional 0.5%. For people with a score of 775 or over, buying a car is often full of good options. Obviously, the more you can pay per month, the faster you’ll own your car outright, and the less you’ll pay in interest. Based on these numbers, here’s what paying off a car will look like based on a variety of monthly payments and loan duration, assuming a loan of $30,000.

Obviously, the higher the interest rate and the longer your term, the more you’ll wind up paying to interest. For each of these five options, here’s the total amount you’ll wind up paying:

- $650.72/month for 48 months = $31,234.56 total.

- $525.70/month for 60 months = $31,542.00 total.

- $455.68/month for 72 months = $32,808.96 total.

- $396.26/month for 84 months = $33,285.84 total.

- $358.60/month for 96 months = $34,425.60 total.

A bigger interest rate and a longer term obviously means more interest, but in every case, with excellent credit, you’re looking at very low percentages of interest that raise the total cost of your car by less than 15%, even if you take 8 years to pay it off.

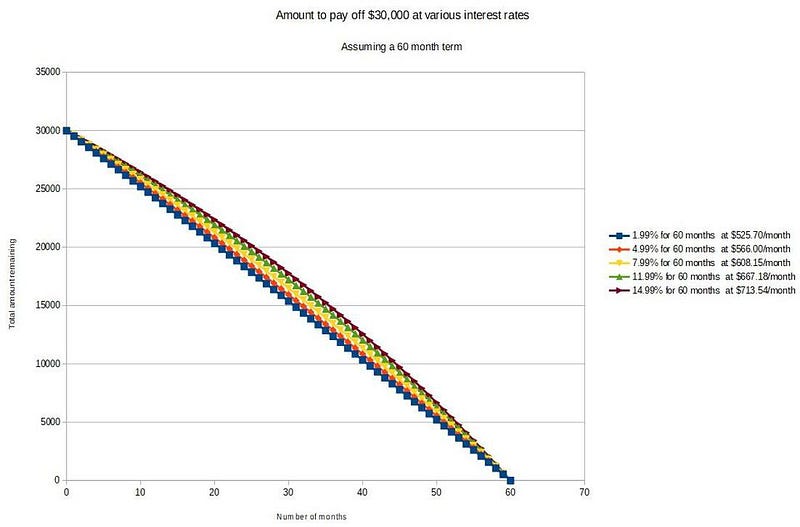

The bad news about bad credit. Everything that’s true about good credit? The opposite is true of bad credit. If your credit score is 100 points lower at 675, your rate for a 5 year loan might be 6.99%; if it’s 200 points lower at 575, that rate might jump to 14.99%. Let’s take a look at that same auto loan of $30,000, and let’s consider the 60 month option, but let’s look at it for five different interest rates instead, which (roughly) correspond to 50-point differences in credit score. The difference that a few percentage points can make is tremendous in the total amount you have to pay, and also in the monthly payment you’ll need to make.

One thing that surprises people is that the different interest rates follow different curves. Did the “good credit” scenario, above, look like straight lines to you? That’s the power of a low interest rate: almost everything that you pay goes to the principal, not the interest. The higher your interest rate, the less of your principal gets paid off initially, meaning your payment need to be higher just to end at the same time. For a 60 month term, here are the total costs:

- 1.99% interest at $525.70/month = $31,542.00 total.

- 4.99% interest at $566.00/month = $33,960.00 total.

- 7.99% interest at $608.15/month = $36,489.00 total.

- 11.99% interest at $667.18/month = $40,030.80 total.

- 14.99% interest at $713.54/month = $42,812.40 total.

Note that, with bad credit, even with a relatively short (5 year) term, you’re paying over $10,000 more than someone with good credit for the same car.

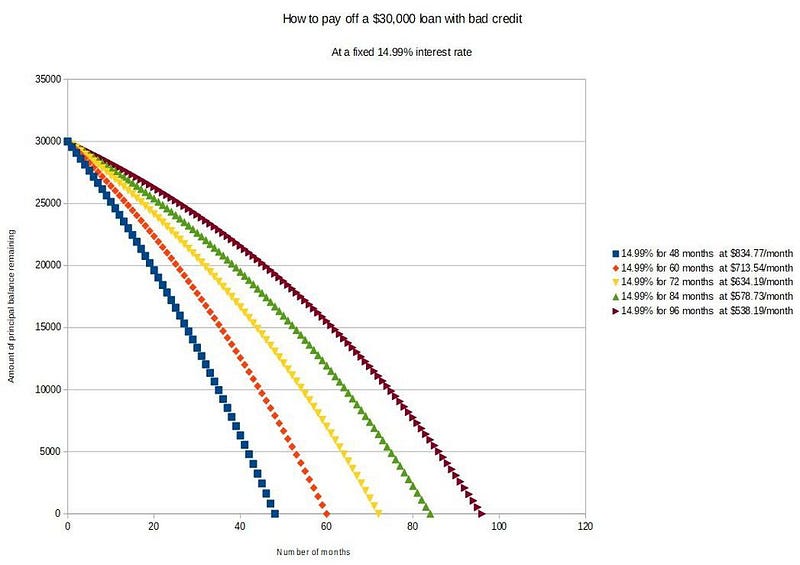

The one question to never answer at the dealer. “How much do you want to pay a month for your car?” This is where they really get you. And by get you, I mean that they sell you a car that you really shouldn’t be buying, given the amount of interest you’ll need to pay. The dealer has every incentive to lengthen your loan term as much as possible; the longer you’re making monthly payments, the more you’re paying in interest. For someone with bad credit, and a 14.99% rate on their car loan, here’s how a longer term lowers your monthly payments, but costs you so much more in the long run.

These figures are terrible; bad credit costs you so much more in the end. Here are the figures for how much each of these scenarios will actually cost you.

- $834.77/month for 48 months = $40,068.96 total.

- $713.54/month for 60 months = $42,812.40 total.

- $634.19/month for 72 months = $45,661.68 total.

- $578.73/month for 84 months = $48,613.32 total.

- $538.19/month for 96 months = $51,666.24 total.

If your interest rate were even worse — say, 19.99% — an 84 month loan would literally bring your total payments to over $60,000: more than double the original price of the car.

Let’s now go to the worst-case scenario: someone who has bad credit who answers the question, “how much do you want to pay a month for your car?” If you say $500/month, you’re going to pay $500/month for the next 9 years and 3 months: a total of $55,500. If you pick a lower figure, like $400/month, it will literally take you 18½ years to own this car outright, and a total cost of $88,800!

It’s true that most dealerships won’t give you a loan for more than 84 months, and that’s a good thing: the potential for abuse and predatory lending is far too high already. If you have bad credit, it automatically winds up costing you more in the long run. But if you have bad credit and take longer to pay your loan off, that’s the worst case scenario, and you can easily wind up paying twice as much for your new car just from that. Next time you walk into that dealership, don’t get lured into a conversation about how much you can afford to pay per month; talk in terms of interest rates, and fight for every fraction-of-a-percent you can get. If you can do the math (and the internet can help), you just might walk out of there with the best deal your credit score will allow.

Ethan Siegel is the author of Beyond the Galaxy and Treknology. You can pre-order his third book, currently in development: the Encyclopaedia Cosmologica.