Barry Nalebuff tells us how game theory can be applied to the economic crisis and where he sees the economy in the next few years.

Question: How applicable is game theory today?

Barry Nalebuff: I do believe that game theory is the way of seeing the world and therefore, in some sense, applies to everything.

How much it gives you a new insight? Well, that depends on the circumstance.

I could take one example right now which is the crisis we’re seeing and the [US government's financial] bailout. And people are talking about using an auction as a way to buy a lot of the distressed debt. Auctions are great. On eBay you can buy a paste dispenser or a plane from the government of Alaska perhaps. But it turns out auctions work much better for selling things than for buying things.

So the standard auction we think about, you got the paste dispenser for sale and lots of people bidding cash. In this type of auction, you have to flip things, you would have the government paying cash and buying bonds. Now, normally these are called procurement auctions or reverse auctions. The challenge is that when you’re doing that, people are selling you stuff of different quality.

So if you are buying a road, for example, and you take the lowest bid, well, you might put enough specifications, so you think the different contractors are pretty similar. But if you said, I’ll give you 50 billion dollars and who will give me the most bonds? The people are going to give you those bonds and the ones with the worst ones. So you will end up with something called the winners curse; it will be a disaster.

So, while auctions work great for selling things, they really don’t work so well for buying things when the quality isn’t clear and that’s what we’ve got in this case.

So, I’d like to think that game theory, and this application to auctions, could help us from really screwing up in this circumstance.

Question: Is it possible to understand the financial crisis in terms of game theory?

Barry Nalebuff: I would say it’s appreciating that people were thinking about a short-term game and imagining that there will be a sort of continuation.

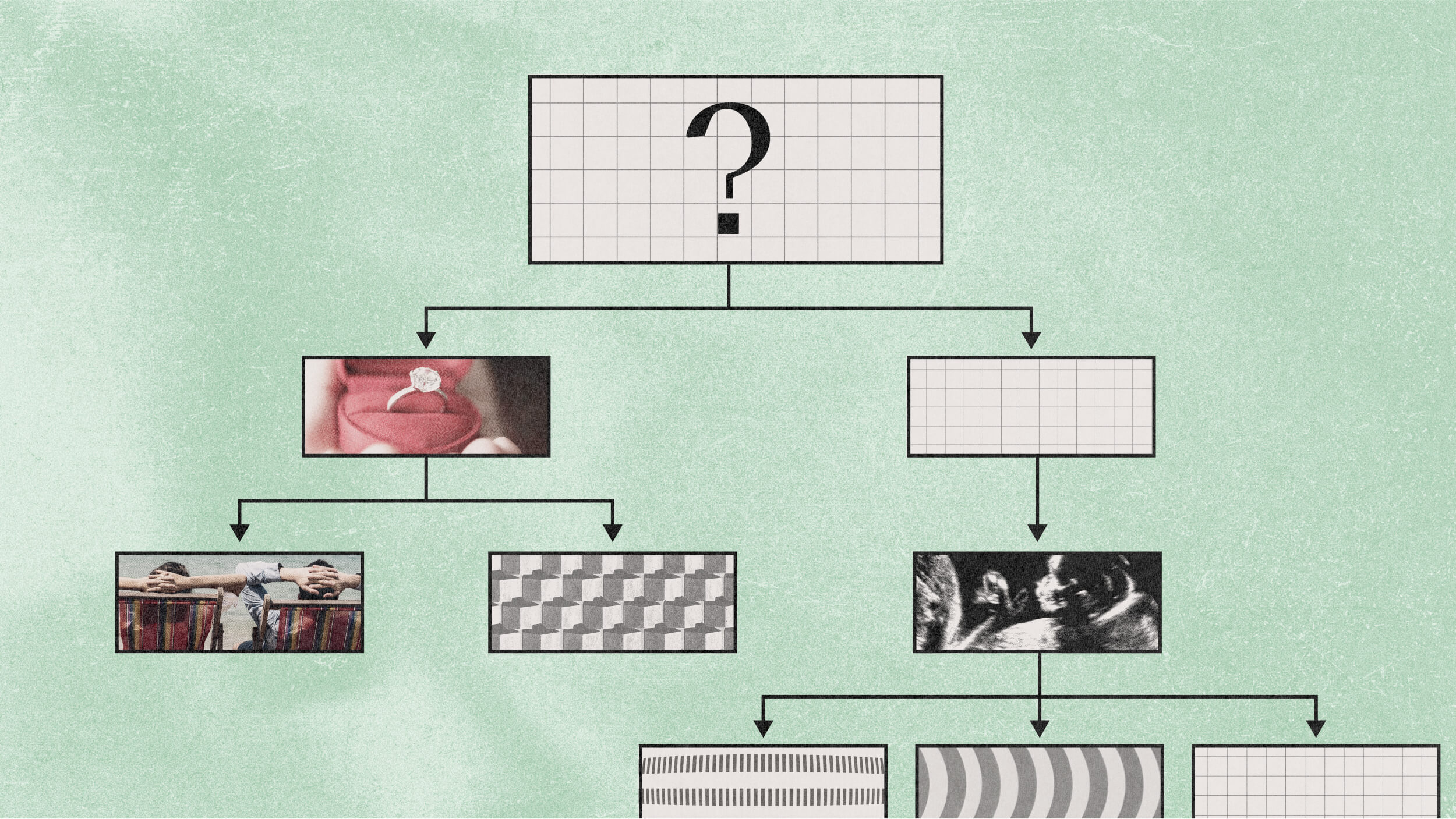

For example, homeowners, when they took these mortgages with the teaser rates, and then they are going to have the 12% interest rate to come, they never expected they’re going to pay 12%.

And the banks, by the way, never expected that they’d get the 12%. The whole purpose of this was to force the person to refinance in three or four years when, hopefully, real estate prices will go up.

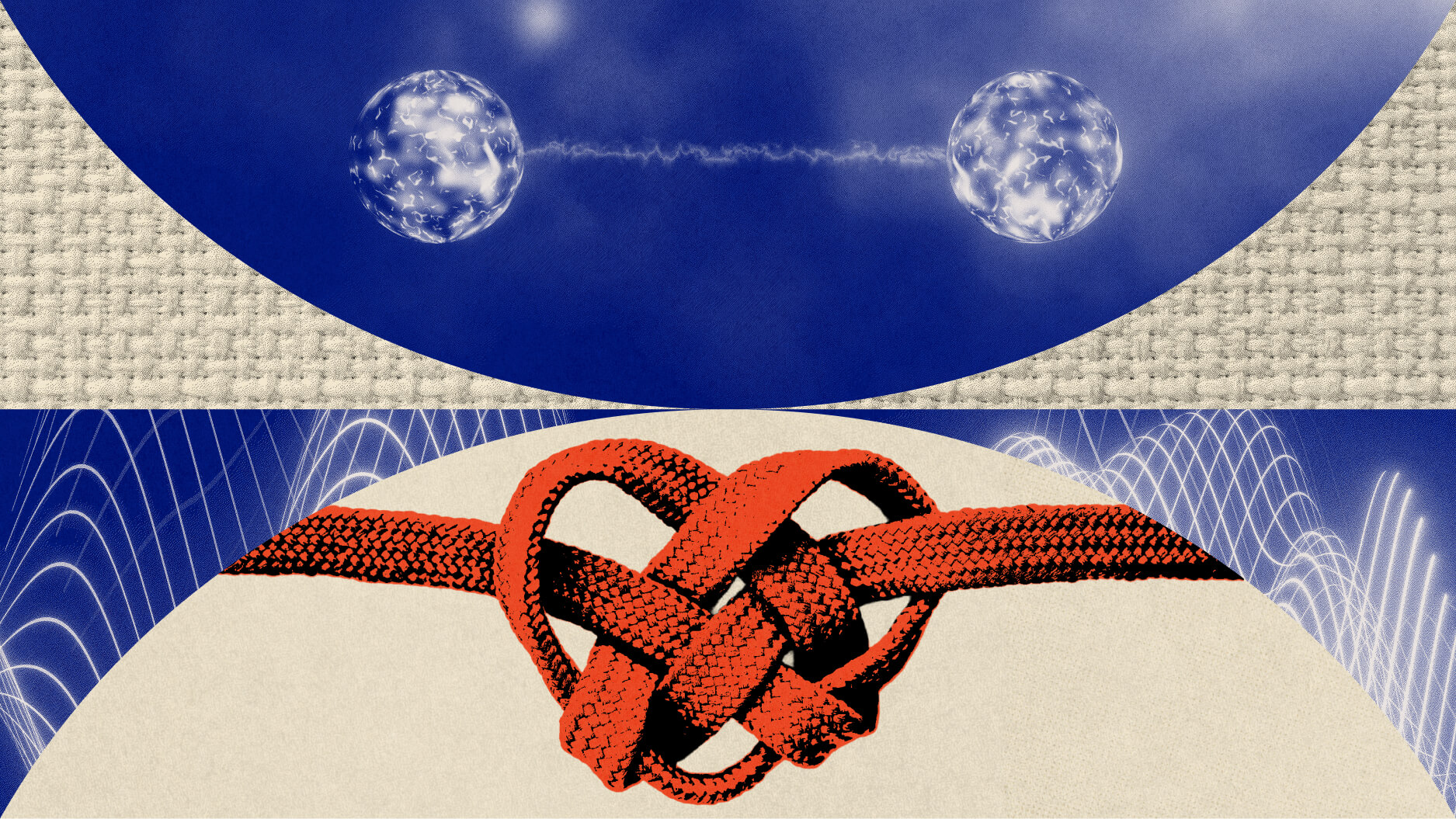

It’s a little bit like what happened with the auction securities market; that sort of the penalty rates. And their failure to really anticipate what would happen in the event that they couldn’t refinance, created a situation where there was no escape, and it got worse because those securities were chopped up into [buying out] of 20 pieces is a very complicated process, where one person gets paid first and another person gets paid second.

So you’ve got a homeowner who is willing to go ahead and pay some amount and not pay the 12% that nobody thought. But there’s nobody that we negotiate with because you’d have to get 20 different people’s agreements. And the problem is, anyone person says, well, excuse me, you need my agreement, you’ve got to pay me something for it.

So what game theory says is, that when there are 20 people who all have to say yes to get something done, the chances of getting something done easily and quickly are pretty darn difficult.

Recorded on: Oct 2, 2008