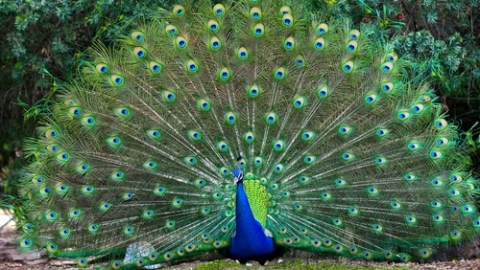

How Unmarried CEOs Are Like Peacocks

This week on Animal Kingdom, observe while the finely plumed CEO spreads his majestic tail in an attempt to attract a mate. This decorative display may be effective, but doing so requires aggressive investment policies. Is the effort worth exposing himself, and his shareholders, to so much risk? If we are quiet, we just might find out.

New research out of the Wharton School of Business this month finds that single CEOs adopt policies that significantly increase the stock price volatility – by 13% — all in the pursuit of finding a high quality mate.

The basic idea is this: Highly attractive marriage partners are scarce and, as a result, single high-income earners, like CEOs, must compete heavily for their attention. The competitive marriage market implies that single high income earners value each additional dollar they earn more than do married high-income earners. This is because that additional dollar not only gives them the ability to consume more, but also improves their chances of finding themselves a hottie. Since single high income earners value their income more than do married high income earners they are encouraged to assume investment policies that are more aggressive and expose shareholders to greater risk in pursuit of more income.

Just in case you are wondering, the authors do not control for gender – so they assume the female CEOs and male CEOs alike worry about status in attracting a mate.

This result suggests that the rich are different than the rest of us since, in general, single men and women tend to take on less risk in their investments then do married people – not more.

The difference between single CEOs and the general population of single people could mean that CEOs face a more competitive marriage market. But I don’t understand how that can possibility be true (everyone who would be willing to date a high income person please raise your hand).

It might be true that income and status matter more to potential partners on the high-income marriage market, but I also find that dubious. Everyone else has to worry about keeping a roof over their head, not just how close they will be to the beach when they build their new house in Naples.

I think is it very wrong to assume that only the wealthy care about their future partners’ earning potential when making marriage decisions.

The one possible explanation as to why single CEOs assume more risk than married CEOs, while in general single people assume less risk than married people, is not that single CEOs are more willing to assume risk, but rather that married CEOs are willing to assume less.

If I am a CEO and I have a high quality partner, and possibly children, and we have a good standard of living, do I really want to assume additional risk just to make it so we can have more stuff?

My observation is that wives very rarely leave their husbands because their income is not increasing fast enough, but I have seen women walk away from husbands because the Naples beach house had to be sold even though they still had a very high income.

Regardless of why the authors find this result, the empirical evidence is sufficiently convincing to suggest that investors should consider the marital status of the person in charge of the firm when allocating assets (according to risk) within their portfolio.

Reference:

Roussanov, Nikolai and Pavel G. Savor (2012). “Status, Marriage, And Managers’ Attitudes To Risk.” National Bureau of Economic Research Working Paper 17904. http://www.nber.org/papers/w17904