Modeling The Muddling Masses: The Newton vs Darwin Pattern

Few maximize. Most muddle. Yet economists mainly model the happy few. The math is easier, but unrepresentative. Using less math and more logic, we can model the muddling masses. Reality’s richer patterns require better metaphors and methods. And grasping how Newton and Darwin differ.

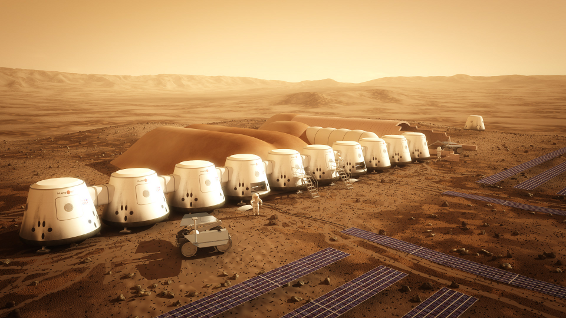

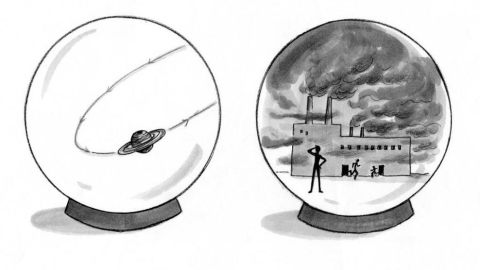

The Newton pattern is science’s holy grail: universal laws, fixed interactions described by tightly causal equations. The Darwin pattern is fundamentally different: universal processes whose logic, applied locally, creates a looser causality, including parts with behaviors that aren’t fixed, often involving choice and change. Hence detailed outcomes aren’t as mathematically describable or predictable.

Alan Greenspan compares models to maps, saying both must exclude details. This is unwittingly wise: Maps can’t cover the undiscovered. And models aim to peer beyond historical data, into uncharted futures. One way economists exclude details is by equation filtering. Paul Krugman says there’s no “rigorous way to model” even “obvious empirical” facts if they can’t be put “in equations.” Ignoring such inconvenient truths, often entails three mistakes.

First, having equations doesn’t equate to having good models. Even Newton-pattern crystal ball equations can’t always map the future. To quote Tom Stoppard, “We’re better at predicting what happens at the edge of the galaxy than…whether it’ll rain on auntie’s garden party three Sunday’s from now.”

Sophisticated climate model equations don’t guarantee good predictions. Hayek believed economics was worse than the weather, since it involves more than the “essentially simple phenomena” of physics. Economies are “complex adaptive systems,” with changing parts and behaviors fitting the Darwin pattern.

Second, equations can be used to ignore paths. Irritated by comparisons between economics and evolution, Mark Thoma says both use equilibrium short-cuts. He illustrates using frog spacing strategies around a circular pond containing a snake. The equilibrium solution is easy: frogs forming one bunched group maximize survival. But Thoma discounts as “basically irrelevant” the “enormous complexities” and umpteen generations spent getting to equilibrium. Faster economic adaptations might hasten equilibria, but they also quicken disruption. Since there’s profit in pushing markets away from prior equilibria, non-equilibrium effects likely matter. And as Herbert Gintis notes, equilibrium conditions haven’t successfully modeled a beehive, never mind the complexities of an economy.

Biologists don’t do macro-evolution. Nobody uses micro-physics to model ecosystems.

Third, logic that can’t be put in equations can still be rigorously modeled. And logic can describe things math can’t. The field of “complexity economics” avoids or reduces equation filtering and equilibrium shortcutting by using “agent based modeling.” Agents with conditional scripted logic can make choices not easily summarized in algebra. And scripts can be diverse, including maximizers, muddlers, and various rules of thumb, or maxims, or “cognitive biases.”

Simulating many scripted agents enables non-equilibrium modeling. The deep-metaphors, methods, and even goals of economics are from the Newton-pattern. Should we expect them to outperform, or even match, weather forecasting? New tools and methods, like agent-based models, will be needed to deal with known but excluded behaviors, and with the much greater complexities involved.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.