Obamacare Isn’t Radical

Earlier this week I argued that the Affordable Care Act should be ruled constitutional. There are genuine reasons to be concerned about the scope of Congress’ commerce power, which has been used to justify the federal laws concerning what appear to be non-commercial issues that could easily be addressed by local laws. Gonzales v. Raich, for example, affirms the federal government’s power to criminalize under the Commerce Clause the growth of marijuana for personal medical use, even in states where it would otherwise be legal. But I argued that the Commerce Clause of the Constitution was intended to give Congress the power it needed to address commercial issues that no state can readily solve on its own. This is what Jack Balkin calls the “interstate externalities principle.”

Nevertheless, Justice Kennedy suggested in oral argument that by creating “an affirmative duty to enter into commerce” the health care mandate is “unprecedented” and “changes the relationship between the federal government and the individual in a very fundamental way.” The health care act would arguably exercise the commerce power in a somewhat new way—Carl Cecere puts the debate in the context of the history of the commerce clause here. But Kennedy is wrong to suggest that it would really be any different from the way the federal government already uses its power.

The health care law doesn’t call for people who don’t get insurance to be thrown in jail. It calls for people who don’t have insurance to pay a fine. As I wrote earlier this week, fining people who don’t have insurance is essentially the same as offering a tax break for people who have insurance. And the federal government already offers tax breaks to encourage an enormous variety of activities, many of which are a lot less valuable than buying health insurance.

Consider that you can deduct the interest on your home mortgage from your federal taxes. Giving people who buy houses a tax break might seem different from penalizing people who don’t buy houses. But giving a tax break to people who have mortgages means relatively higher taxes for people who don’t have mortgages. The economic effect is to redistribute money from people who have outstanding mortgages to people who don’t have them. This effect is exactly the same as fining people who don’t have mortgages. The mortgage tax deduction actually seems a lot more problematic to me than fining people who don’t have health care—why should I pay a penalty for not buying a home? why am I financing homes for people who can’t otherwise afford to buy them? And the mortgage interest deduction is just one of the numerous deductions you can take.

There’s a real debate to be had over whether a health insurance mandate is a good idea. It would push Americans to buy into a free market version of a national insurance program, and have the effect of making those of us who don’t get sick subsidize the medical care of those who do. But let’s not kid ourselves that offering people an economic incentive to behave a certain way is some kind of radical new assault on freedom. That’s just overheated partisan nonsense.

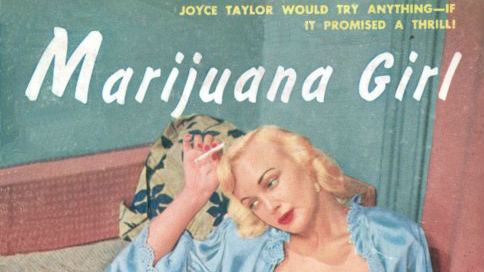

Justice statue image from Shutterstock.com