Santorum, South Carolina, and Social Media

— By Victoria Bassetti, David Norton and Alan Rosenblatt

Now that Mitt Romney can claim two wins in the Republican primaries/caucuses, where do his rivals go?

We know physically: South Carolina and Florida. (And seriously who wouldn’t want to be there in January?)

But for Rick Santorum, who hopes to emerge as Romney’s most threatening opponent, the path to nomination is long and hard. However, he does have a potential route to victory.

Earlier we used social media data to take a look at Newt Gingrich and questioned the real strength of his surge. Using that same data from the social media analytics firm Colligent, we found that Santorum is positioned to solidify support in the South, to siphon the buzz from many of his rivals, and to build his base among socially conservative voters. Indeed, he already made one big move last weekend when he garnered major endorsements from evangelical leaders.

But fair warning: he’s merely positioned to make a move. At the end of the day, his ability to do so will turn on time and money, both things he’s relatively short on.

More broadly, however, we think this Santorum data shows continuing volatility in the Republican primaries and tepid support levels for Romney, the presumptive nominee.

Using data drawn directly from Santorum’s social media channels by Colligent, we look at the way he might try to find a path from two losses – one very, very close and one a trouncing – to a series of wins. Our analysis looks at some guideposts on his path: the makeup of the fan bases of the South Carolina Republican Party on social networking sites; the fan bases of the major candidates for the Republican nomination; and the fan bases of the largest conservative issue groups (e.g. National Tea Party Patriots).

Note: As is true across social media, fan bases include an unknown percent of people who are fans only in order to engage, not because they actually like the candidate or group. Thus our analysis has the tendency to overstate real support for any candidate or group.

Heading South

South Carolina looks like a relatively fragmented and fluid race. At the end of October, three candidates were in the hunt: Newt Gingrich, Rick Perry and Mitt Romney. Since then, Santorum, Jon Huntsman and Ron Paul have each emerged as real contenders with real momentum, though Huntsman’s momentum came to a screeching halt when he ceased his campaign on the 15th.

At the end of October, social media fans of the South Carolina Republican Party (more than 11,000 of them) were mostly focused on Gingrich, Perry and Romney. But when the winds started shifting in late 2011, as one candidate after another surged anew, those supporters began taking a closer look at the alternatives.

Overall, South Carolina Republicans look volatile and open to all comers. And that’s a fundamental advantage for the late arriving contenders. Neither Romney nor next-door-neighbor Gingrich have locked in support in South Carolina. Meanwhile, Rick Perry let his early lead stagnate. Santorum, Paul and even Huntsman used the opportunity to position themselves for a strike at winning the upcoming South Carolina primary.

Popularity Contest

In South Carolina, and beyond, as the field of candidates narrows, the remaining contenders will look to poach supporters of former candidates. And many political commentators will speculate on the affinities between supporters of various politicians. Some will use anecdotal evidence or intuition. Others might look to the crosstabs of polls that ask respondents to name a secondary candidate preference. But we can use social networking data – in real time – to see the real affinities between the supporters of multiple candidates.

For example, there was a great deal of speculation early in Gingrich’s surge that he was actively courting Herman Cain’s endorsement in an effort to pick up his supporters. And for good reason: if he were to obtain Cain’s support, he could tap into the substantial overlap between their fan bases, converting Cain loyalists to his side.

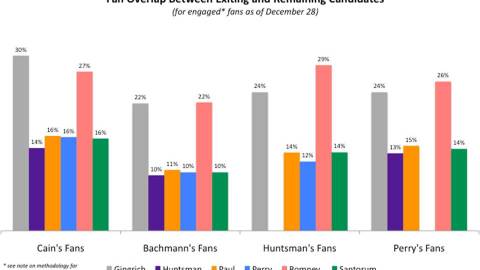

So who among the five remaining candidates has the best chance of picking up supporters from the exiting three (Bachmann, Cain and Huntsman)? And what about supporters of Perry, since he seems likely to quickly run out of steam?

A superficial look at the data shows that Gingrich and Romney, with their deep pockets and familiar names, are likely to be the leading beneficiaries of their rivals’ declining fortunes.

But there are some interesting things to note:

First, Santorum and Paul are within striking distance for picking up Cain, Bachmann, Huntsman and Perry supporters. For people who were written off as minor, nuisance candidates, they are getting a higher level of attention from other candidates’ supporters than one might expect given the media’s estimation of their chances.

Second, relatively speaking Santorum is doing well. In general, politically active social media participants tend to like Gingrich and Romney. The interest in Santorum expressed by the Cain, Bachmann, Huntsman and Perry fan bases is outsized….over-indexed. They’re more interested in him than they should be on average. Which means he’s been making inroads…or put another way, punching above his weight class even as he strained with limited resources. So is Huntsman. (See chart at end of the article showing the index for the candidates.)

There’s no certainty that he will pick up supporters from Cain, Bachmann or Huntsman’s supporters, but the data shows that rather than ignoring him or counting him out, those supporters are taking a look and considering him.

Chess Club

The final guidepost on Santorum’s path to being a real challenger lies in the data on the major groups of Republican faithful.

In order for Santorum (or Paul for that matter) to see real growth, he needs to solidify and grow support among key groups and causes. We had a chance to look at the data for six of the top Republican affiliated groups. We looked at these six because they have the highest number of fans and followers on social media sites and/or because they are ideologically important to the Republican Party.

And here’s where the story starts to get even more interesting. Gingrich is the clear favorite among all six of the groups. He does notably better than Romney who has been lavishing time and money on gaining support from the Republican establishment. But they just have not completely swung Romney’s way. Gingrich and Perry outrun him in virtually every case. And Santorum – underfunded and doing it with shoe leather – has managed to garner levels of interest that belie his poor polling and long-shot odds.

Come January 21, the voters in South Carolina will have a lot to say about the future direction of the contest for the Republican presidential nomination. The social networking data shows that Santorum has a slim but fighting chance in the Palmetto state and beyond. Santorum has quite a distance to go to close the gap between him and Romney.

Yet the Republican faithful show their lukewarm feelings about Romney in their social media behavior. All of Romney’s opponents seem to have a chance against him based on the social media data. But more often than not it’s money and momentum that carry the day. We’ll see how it all plays out in South Carolina soon.

Graphs were created by Victoria Bassetti using the raw data from Colligent.

Victoria Bassetti heads Colligent’s political unit. She was the head of consumer insight for EMI Music NA and prior to that worked on the Hill for eight years.

David Norton is the Social CRM Manager at the Center for American Progress, a fellow at the Center for Progressive Leadership, and a freelance digital advocacy strategist.

—

Note on Methodology and Charts

Colligent measures the publicly available social networking profiles of more than 313 million Facebook, Twitter and MySpace users. Colligent only tracks active social network users. A user who has neither posted nor tweeted in the last year is eliminated from its database.

Colligent cross-references user affinities and behaviors against 35,809 entities (e.g. politicians, brands, TV shows) on those networks. In the political sphere, Colligent tracks 389 interest groups or charitable organizations (e.g. RNC and the Red Cross) and 649 elected officials (e.g. Barack Obama or Joe Arpario).

The data is refreshed weekly. For this piece, where we have measured engagement or overlap over time, we covered the time period from November 2 to December 28. Where the data is static we drew from the December 28 Colligent data batch. In addition, we only drew from US-based fans or followers for this analysis.

In the case of the South Carolina Republican Party we only looked at US fans. We can particularly track 6,737 of that entity’s fans. Of them, 2,022 report location data that we can track. Forty percent state that they are based in South Carolina and another 8% are in the immediate vicinity (e.g. Charlotte, NC). The largest non-South Carolina block of followers (7%) is in New York and Los Angeles.

For every entity tracked, Colligent has data on only a portion of their reported fans. The average proportion of Tracked Fans to Reported Fans for the 15 entities dealt with in this report is 25.8% so we are sampling on average 25.8% of the fan base. The lowest sample ratio of the 15 candidates or entities covered in this piece is for Christians United for Israel where the sample ratio is 2.9% or 15,998 fans.

Colligent gathers data on the 313 million individuals and records what brands or entities they “like” or “follow,” whether they have engaged with any of the entities they follow or like including whether they commented, “liked” a post, posted a photo, retweeted or hashtagged. It also gathers location and demographic data on the fans to the extent available under applicable privacy laws.

Colligent segments consumers based upon their activities and determines whether a fan of a particular entity is a “super,” “loyal” or “casual” fan. Super fans in general interact with an entity more than once in a six-month period (e.g. retweet multiple times). A loyal fan interacts only once in that period, and a casual fan has done nothing more than follow or like. In this piece “engaged” fans are super and loyal fans combined.

For South Carolina Republican party and other group analysis we looked at all fans on the theory that to begin any fan of these groups is already relatively committed to it and that a high level of engagement is not vital to understand overlaps.

In contrast, when we analyzed the overlap between candidates we did focus on engaged (or super and loyal) fans, since these are the loyalists and activists who are most likely to show up either at the polls or to donate or to volunteer.

Colligent only analyzes behavior. It does not analyze the sentiment of the text of posts or retweets. This raises the interesting question whether someone who “likes” Gingrich actually “likes” Gingrich. There has not been a comprehensive study done on this to the best of our knowledge. (And studies of sentiment analysis of text-based data indicate both a very high error rate and a high portion of unclassifiable posts).

Anecdotal evidence of course points to the fact that a portion of any politician’s followers is in fact comprised of skeptics or opponents who are engaging in “opposition” monitoring. We do however think that as a general rule the double combination of Gingrich fans who also like Romney (or for that matter Heritage Foundation fans who also like Perry) allows us to focus in more narrowly on real supporters sifting out a large portion of “trolls” or “opposition monitors.” We feel comfortable then in concluding that the stated portion of followers of the Heritage Foundation are sincerely interested in, say, Gingrich.

In addition, since we are comparing candidates and groups, much of the impact of including “trolls” into the sample is washed out. All the candidates and groups suffer internally from the problem equally. Thus, the relative growth or power of Gingrich versus Santorum followers among Heritage Foundation fans is valid.