Markets & Curing Spontaneous Disorders

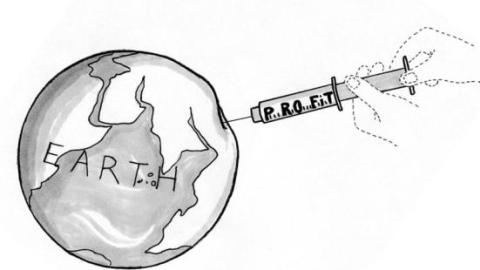

Is the “invisible hand” always benign? Or can it be bad? Free-market fans love the idea that “spontaneous order” emerges from local decisions. But what prevents “spontaneous disorder”? Does prudence reliably trump profit? Disorderly superbug and climate change situations say no.

Adam Smith launched spontaneous-order thinking about markets. “The rich,” he said ”are led by an invisible hand to…without intending it, without knowing it, advance the interests of the society.” Smith rightly separated intentions from effects, since markets aren’t simple systems. But today’s “markets in everything” crowd ignores a class of problems that local incentives can’t solve.

Tyler Cowen calls climate change “a problem we are failing to solve.” With other prominent economists he says clean-energy can’t work unless it’s as profitable as unclean energy. Sounds reasonable? Let’s translate: many economists think we can’t save the planet unless it’s profitable. Does that sound prudent?

Superbugs (antibiotic-resistant bacteria) are another example. Overuse of antibiotics contributes to 23,000 superbug deaths annually in America. Despite the fact that the more an antibiotic is used “the greater the likelihood that resistance to” it will develop, drug companies, and patients (requesting medically unneeded antibiotics), and doctors (routinely over-prescribing) have all abetted overuse. Leading the CDC to warn: “We’re in the post-antibiotic era.” Profits before prudence again.

Partial superbug fixes fail. If anyone overuses, an avoidable risk of resistance continues. As with climate change, a self-defeating cycle operates: If not everyone switches to the known to be more prudent behavior, why should I? Problems like this need coordinated agreement, managed transitions, and enforcement. Otherwise, many will continue to benefit individually while making the collective situation worse. Cowen and company acknowledge, in effect, that free markets don’t coordinate like that.

Economists have labels for parts of these coordination problems—externalities, tragedy of the commons, property rights—but seem unable to assemble solutions. Externalities don’t fix themselves. And no property rights tweaking can fix the superbug or climate problems. No fence can separate your interests from the climate or bacterial commons.

Spontaneous-order thinking assumes that we wouldn’t voluntarily damage our own long-term interests. But many often do. Beyond the above, consider diet and money management. And imprudence is profitable. Markets—the most powerful social forces on earth—will “efficiently” and “rationally” create and exploit imprudence as much as they’re allowed.

Superbugs, climate change, and the tragedy of the commons are all Darwin’s Wedge scenarios, where individual incentives diverge from group goals. In such cases, the “invisible hand” makes mischief. When disorders arise we must seek fitting treatment, including if necessary, centrally administered cures. Free-marketeers, it’s time for your medicine.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.