Shakespeare’s Invisible Hand in Economics

Metaphors can be our shortest stories: their compact explanations often shape our view of the truth. But like stories taken out of context, badly mixed metaphors from biology and physics mislead many economists. And Shakespeare’s “invisible hand” is partly to blame. Here’s how:

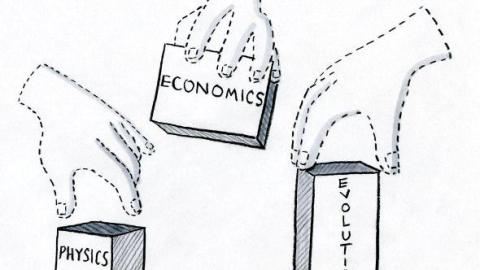

1. Science’s theories—its verifiable stories—often have metaphors built into their formal models (sometimes implicitly). The conceptual skeleton of economics—that an “invisible hand” guides rational self-interest in competitive markets to optimal social equilibria—mixes a loose biological analogy (competition ensuring efficiency and survival-of-the-fittest) with ill-fitting formal models from physics.

2. Adam Smith popularized the “invisible hand” idea. He lectured on Shakespearean imagery and would have known of the line “And with thy bloody and invisible hand” in Macbeth. Smith first used the phrase in his History of Astronomy: “nor was the invisible hand of Jupiter ever apprehended to be employed,” meaning no hand-of-god was needed to explain astronomy.

3. Perhaps the most prominent “invisible hand” in biology is in evolution, where we know it produces unintelligently, undesigned results. Yet competition in biology doesn’t guarantee efficiency (“tree trunks are standing monuments to waste”) and regularly delivers foreseeable disaster. Unless it’s intelligently guided, competition in economics can be as dumb as trees.

4. General equilibrium theory in economics was shaped by Josiah Gibbs (the physicist Einstein called “the greatest mind in American history”). Gibbs invented statistical mechanics to describe the behavior of large aggregates like gases. An appealing metaphor since economies are also large aggregates? Well, the “invisible hand” equilibria of physics emerge from parts that interact utterly consistently. But people aren’t gas particles or biological billiard balls. We evolved behavioral flexibility. Our actions and reactions vary (complexly, often game-theoretically).

5. Newton’s science is metaphorically and structurally different than Darwin’s. Newton’s systems have closed causality and converge on mechanically calculable patterns. Physicists have good mathematical tools for predicting their specific results. But Darwin described open, generative, and divergent processes with less predictable outcomes. The shapes of these processes are stable, but their resulting “endless forms” aren’t as pre-calculable. Economics, though it loves physicsy-math-tools, has unavoidable evolution-like aspects (and evolutionists don’t find physicsy-math-models to be that useful).

6. “Invisible hand” emergent equilibria in physics, biology, and economics are crucially different. Self-organization—parts spontaneously ordering themselves into wholes—in “nature” is dumb. Intelligent humans can sometimes do better.

7. Biological and economic self-interest are different (e.g. all biological appetites are limited). And what economists call rational can produce poor, sometimes self-undermining, results (examples here).

Nature gave us tools to avoid the dangers of dumb “invisible hand” self-organization. Perhaps the point of being human is to use our evolved capacities for foresight and intelligent social coordination to organize a relationally rational way to live.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.