Unbounded Rationality & Its Consequences

It should not be news that we can’t know it all (ignorance is unavoidable). But the results of using the opposite notion, of “unbounded rationality,” remain influential, often bizarrely mixed with asymmetrically applied ideas about “unintended consequences.”

1. “Unbounded rationality” is built into many economic models (which are deemed to confer near “sacredness” on free market results). For example decisions are assumed to meet demanding standards of “completeness.” Sadly models incorporating “bounded rationality” (our cognitive and data limits) are harder and hence used limitedly).

2. Hayek said “all political theories assume…that most individuals are very ignorant,” adding that everyone inevitably suffers some ignorance (information incompleteness). Hayek reasoned that although we each can only have limited data, that collectively is more information than any central planning could have, so “spontaneous order” is better.

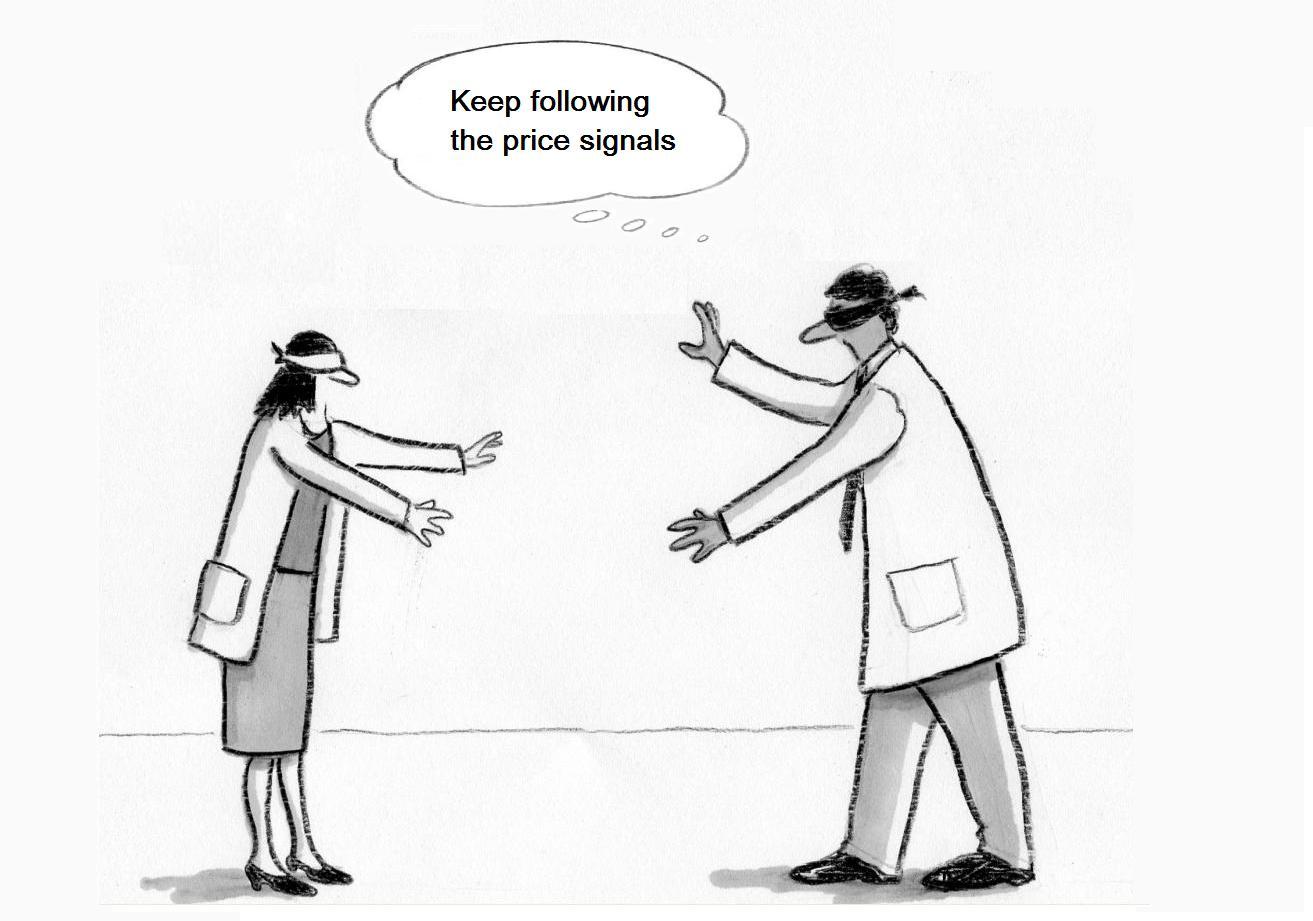

3. Markets = data processing systems: But Hayek’s spontaneous order ignores cases needing nondispersible data (see 9 below). Free markets only process one kind of data in one way (hardwired reflex responses to prices varying one-dimensionally, up or down). That’s like having no central nervous system, or calculating with only one kind of data and no CPU.

4. “Unintended consequences” = unavoidable: Hayek cautioned “we ought not to increase…unpredictability.” Yet many now aggressively promote unregulated innovation (=lower predictability).

5. Regulation “risks all sorts of unintended consequences.” True, but in nonstatic conditions, so does inaction. And free market “invisible handers” depend on its unintended effects (typically miscast as always benign).

6. “Permissionless innovation” promoters risk structural non-science-ness. Its “free-market think tank” developer has openly declared biases in its assumptions and goals (pre-assuming freer markets are better). Physical (reality refereed) sciences aren’t precommitted to particular assumptions or results, only to rigorous bias balancing processes.

7. Seeking less regulation is often just make-my-life-easier whining. All businesses should want good regulation, and dislike bad regulation. That distinction matters. Rules and referees are required to ensure fairness and safety in sports—and markets.

8. Can we trust the mindless coordination of markets to handle the future’s “voyage into the unknown”? What if some element of central steering, or guidance, or intelligent nonlocal adjustment, is needed? Perhaps that’s why central nervous systems evolved. They can beat distributed reflex-only systems.

9. Markets solve many problems well. But not all (e.g., Darwin’s Wedges, or where externalities lower costs for all transactors). Without guidance/regulation markets do only one kind of coordination: “deciding” via incomplete prices and often imprudentcustomer choices (like a mass tug-of-war with millions of players pulling on separate ropes).

Central guidance/steering isn’t “central planning” (both Hayek and Adam Smith saw this). It’s more like steering a ship and regularly adjusting to changing conditions and observed effects). We must use what is foreseeable to prepare prudently for what isn’t.

Illustration by Julia Suits, The New Yorker cartoonist & author of The Extraordinary Catalog of Peculiar Inventions