Luck and The Researcher: Kahneman’s Path to Prospect Theory

Editor’s Note: This article was originally posted in October, but has been reposted here to illuminate the research approach of Daniel Kahneman, a recent guest on Big Think.

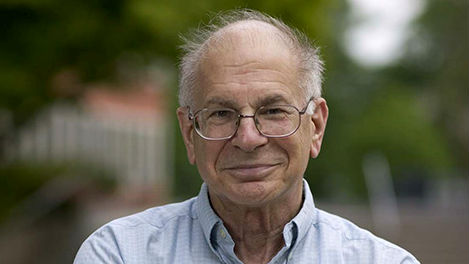

On Monday evening, I went to see Daniel Kahneman give a talk on his new book, Thinking, Fast and Slow. Kahneman, currently a professor emeritus at Princeton, won the 2002 Nobel Prize in Economics for work that he did back in the 1970s with Amos Tversky on Prospect Theory—the basic foundation of behavioral economics, or the notion that we are far from the homo economicus ideal of the rational decision maker. But today, I don’t want to write about Kahneman’s work or his invaluable contribution to the study of decision making and the workings of the human mind, but rather, about something much more general: his approach to research.

Was It Really Luck?

Kahneman, despite his myriad accomplishments, presented a modest picture: with photographs of Amos Tversky projected onto the screen behind him—Tversky passed away in 1996—he said simply, “We were lucky.” But was it really as simple as all that, reducing some of the most notable findings in psychology and economics in the last fifty years to a matter of luck, or was it something more?

Luck, of course, played a role, as it does in most groundbreaking research: right place, right time, right minds coming together to focus on the right problem. But more than luck was the research approach itself, the decisions that Kahneman and Tversky made when they started out on the path that would lead to Prospect Theory. Of course, I only have it from Kahneman’s own words, and memory, as we know, is likely to be smoothed out over time, rendered less incongruous and more in keeping with general thoughts and impressions of the moment. But even so—and perhaps even more so—the insights seem to me to be particularly valid ones to keep in mind when embarking on your own path, be it of research or of thought more broadly.

Start simple.

So what did the approach entail? The first aspect was to avoid complex theory. Instead of trying to create a complicated general framework that would cover as much ground as possible, Kahneman and Tversky focused on a narrow, specific phenomenon that was robust and easily described: when does our intuition fail us in making a judgment of probability? Are we really intuitive statisticians, as the article that sparked the research claimed, or are we intuitively…wrong? That, and only that, was what the two men wanted to see.

And so, they came up with concrete problems where the first intuitive answer was the wrong one, where their statistician’s intuition, so to speak, failed. These were problems that were easy to picture, easy to answer (incorrectly, but answer nevertheless), and easy to apply to yourself. They illustrated an interesting, narrow phenomenon that exploited one specific cognitive quirk. And that set of problems? It became the basis for the iconic 1974 and 1981 Science papers, “Judgment Under Uncertainty: Heuristics and Biases” and “The Framing of Decisions and the Psychology of Choice.”

Choose wisely.

In those papers, we see the second element that Kahneman attributes to luck, and I, to research savvy: the choice of proper format. Forget complicated equations. Forget formulations that make your head spin and your mouth open into an involuntary yawn. The examples were real, they were immediate, they were specific, they were easy to grasp and understand. They made sense. And you didn’t need any background in Economics or Psychology to see why. Take, for instance, this demonstration, of a later phenomenon that the duo investigates.

Which of the two statements that follow is more probable:

A mother has blue eyes given that her daughter has blue eyes.

A daughter has blue eyes given that her mother has blue eyes.

If you are like most people, you have an immediate intuition. Statement two is the more logical; it implies some sort of natural generational causality. Except—it doesn’t really. The two statements are precisely equal in probability. The intuition is wrong. And that’s the beauty: Tversky and Kahneman didn’t have to explainthe phenomenon because their readers had just experienced it themselves.

Keep asking questions.

And that brings us to the final element of so-called luck: the ability to keep asking questions. Tversky and Kahneman were excited by their research. They were passionate about it and thought it was interesting. They kept pushing it, seeing how far it could go, how widely it could be applied—and how widely it couldn’t. In short, they tested for both possibilities and limits, for where it worked and where it broke down. They weren’t out to revolutionize Economics or win a Nobel Prize. They were out to understand their own minds and why it was that, despite all of their training and knowledge, they would inevitably make simple mistakes in simple thought processes.

And so, even though they did not embark on their research path with the notion of overturning classic rationality, that is in fact what they did. They never addressed it directly. They never addressed judgment and thinking more broadly. They stuck to the basics, to what they knew, what they could demonstrate, where they felt at home. And from that, a general theory was in fact born. But it didn’t start life that way.

That, perhaps, is the secret to the so-called luck of the researcher. Investigate what you want to investigate, what intrigues you and makes you want to ask questions. Then ask those questions, simply, step by step, without worrying about the broad implications. Apply them to actual life. Keep them grounded. And keep testing their limits. And only then, look back to see where you’ve ended up.

[photo credit: Daniel Kahneman, photo by Jon Roemer]