Is the collapse of a $25-billion cryptocurrency startup a death knell for the industry? Not according to Kevin O’Leary, a Canadian investor, businessman, and author. He sees the failure of FTX as a speed bump rather than a roadblock, underscoring the distinction between speculative assets like Bitcoin and more stable entities like stablecoins.

Despite the turmoil, O’Leary maintains that the potential of cryptocurrencies remains vast. He foresees their integration into the global economy but contends that this only can happen successfully with appropriate regulation to curtail the sector’s “Wild West” tendencies.

As the cryptocurrency community awaits the final outcome of the SEC’s lawsuit against Ripple and other companies, it remains to be seen whether or when digital assets will be incorporated into our daily economic lives.

KEVIN O'LEARY: FTX was a startup, no different than any other startup.

NEWS ANCHOR 1: 'Investors keep pouring money into the industry. It boosts their total valuation to $25 billion.'

O'LEARY: A big startup with a lot of promise and potential in a nascent, new industry called crypto, but nothing more than a startup. And so those who invested in it, including me, they knew exactly what they were getting into: a probability of wild success or utter catastrophe. And I think we now know the outcome.

NEWS ANCHOR 2: 'The collapse of FTX has sent shockwaves across the cryptocurrency industry.'

O'LEARY: I'm watching like everybody else to find out what the facts are. This story will play out for years and years and years. But I tell everybody, "Remember, think about Lehman Brothers or Bear Stearns or Enron," they changed nothing long term, and FTX will come and go and it won't make a difference to the potential of what crypto could be.

There was so much optimism only three years ago.

Hi there, I'm Kevin O'Leary, A.K.A. Mr. Wonderful. I'm the chairman of O'Leary Ventures. I'm an investor.

So, let's divide crypto into two universes: One, speculative assets- Bitcoin being the granddaddy of all of them. Bitcoin, I don't consider a currency. Bitcoin is a speculative asset, no different than gold. I've watched it go down as low as 17,000 and obviously past 60,000. That's speculation, that's what it is. And you're speculating down the road, it will be worth more than it's worth today.

And then let's talk about Stablecoins, which are essentially payment systems. Now, let's keep it real simple: I'm a watch collector. Let's say, as I have recently found, a young watchmaker in Switzerland. He's gonna make 12 watches next year. One of those 12 is going to be mine.

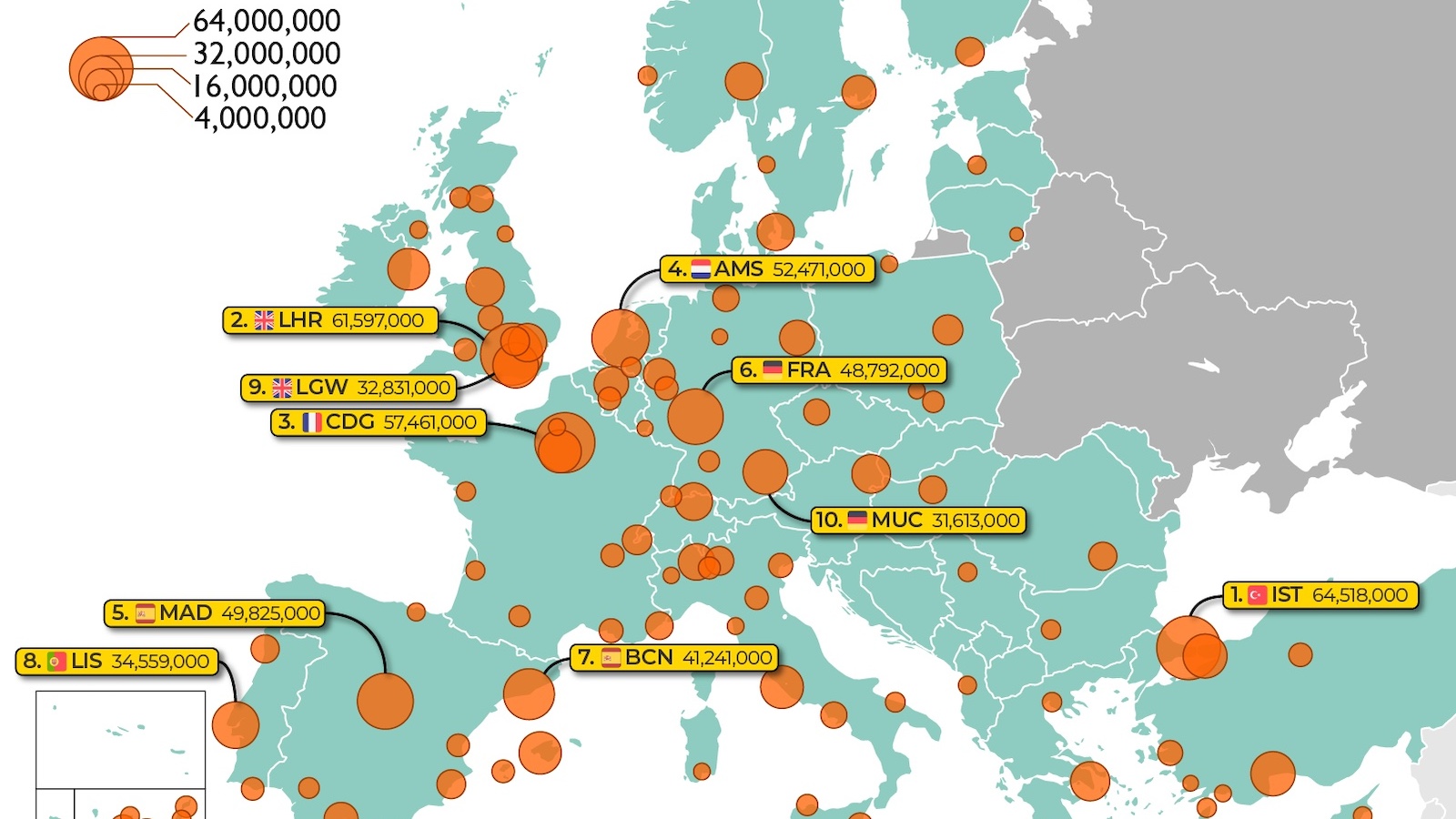

Now, how do you get Swiss Francs to that watchmaker? Well, you start with the American dollars sitting in a bank account in New York, and then you have to wire transfer it to a bank in Zurich; that takes sometimes four days. And it's really expensive, because when you get there, you have to convert it from U.S. dollars into Swiss Francs, then you have to transfer that from that bank account in Zurich to this watchmaker's bank account in Geneva. What a total pain in the ass.

The ACH transfer system, The Fedwire, the SWIFT wire, these were all developed 50, 60 years ago by the private sector and regulated by regulators. But they're old, crappy, expensive technologies today. We need to replace them.

What could do that? Well, a digitized dollar. So, while we've had all of this chaos going on in crypto, the only bill that's surviving scrutiny still moving forward in Congress, on the Hill, is a bill around Stablecoins.

You know, I was having this wonderful dialogue with one of my CEOs last week about the promise of crypto and decentralization and not trusting financial institutions, not trusting the government. And then Silicon Valley Bank blew up.

NEWS ANCHOR 3: 'This is the biggest bank failure since 2008. And this evening, so many customers demanding to know: Where is our money?'

O'LEARY: And she called me up and said, "Oh my goodness, we have all our money there. I hope the government's gonna take care of this and give us back our cash in our account." So there's the dichotomy of, "I hate the government." and now, "I love the government."

Well, the thing about money, if you think about the 11 sectors of the S&P, the financial services sector is the only sector that services every other sector, because you can't run commerce or have an economy without financial services.

This idea of a different planet operating, and everybody's gonna be running around with decentralized wallets and they're not even gonna bother paying taxes to the government- well, who regulates it? Who backs it up? Who do you call when there's no money in your bank account?

Money's a funny thing; people have a unique relationship with it. When it comes to just owning cash, they don't want to take any risk at all. And so, it's great to talk the talk, but no sovereign wealth is gonna put a lot of money into any government that has volatility and instability.

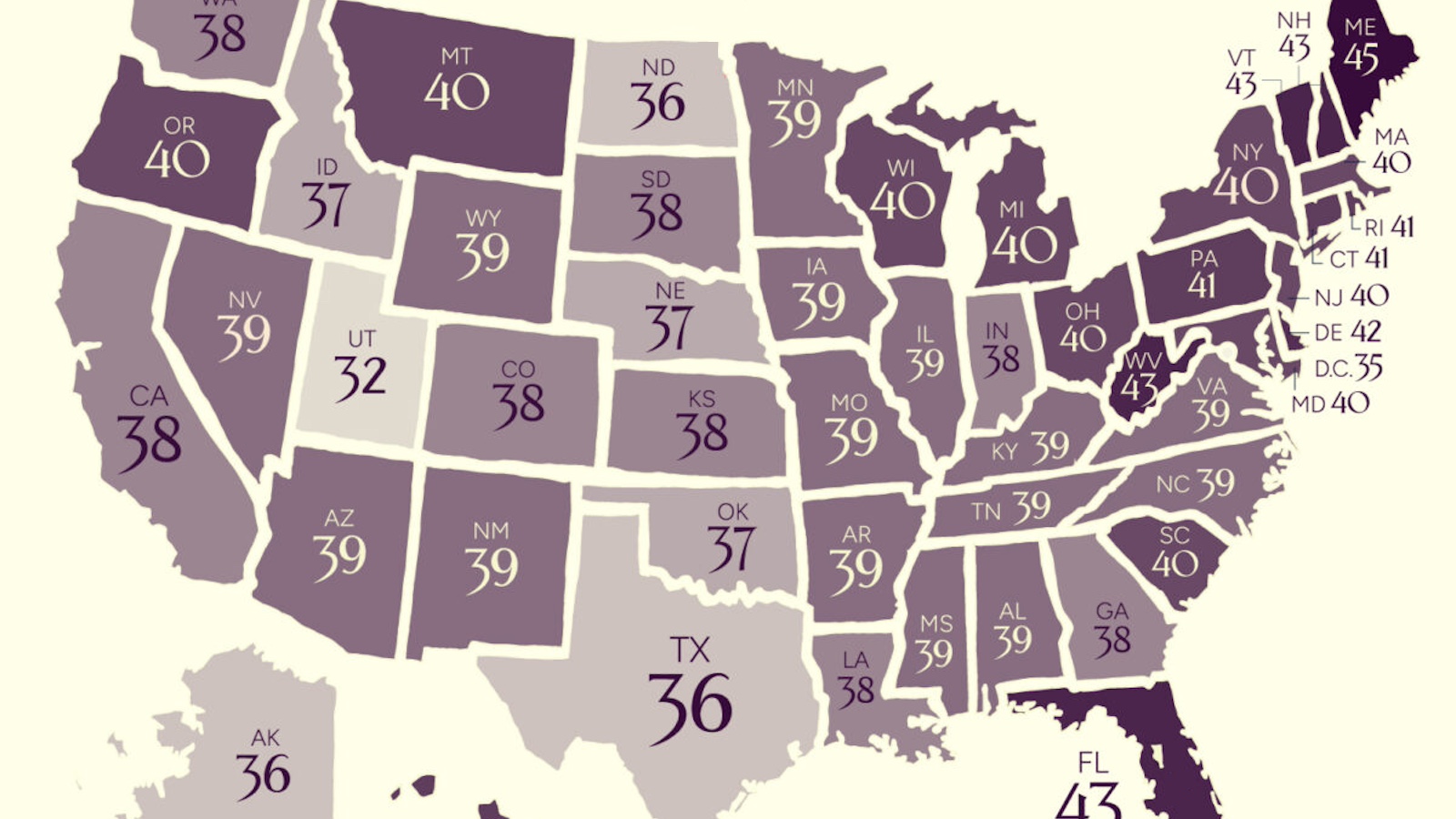

And where do you find the greatest amount of trust, even with all of its problems, where do you find the greatest scale, the broadest economy with 11 sectors? United States of America. And for all of its faults, that's where all the money goes, every day, day in, day out. It's a giant black hole that sucks cash from all around the world because of one word:

You know, governments are going to regulate financial services for the reasons we just saw in the blow up of the Silicon Valley Bank: they want to provide a stable economy based on financial services that provide a payment system for people that operate in the economy or trade globally in it. Every government does that.

Now, if you mistrust government, well, I guess you can just keep gold bars in a cave with some beef jerky, a dog, and a rifle. That's okay too. But that's not for the majority of the economy, it's not useful and not easy to operate that way.

So where do we go from here in crypto? Well, I think we're at a stage where most markets globally, including here in the U.S., if crypto wants to integrate into the global financial service system, it's going to have to be regulated, because unfortunately, there's the greed of man, there's always the dark side.

And so, what was evident over the last three to four years, there's always rogue players taking advantage of the fact that it's the Wild West, and basically stealing stuff. That's what happened. And it got bigger and bigger and bigger, and the litigation rained down, and that's where we're at.

But, the potential of what crypto can be is huge, and I believe it will find its place, but only after it's integrated into financial services in a different way than it is today - in other words, regulated.

NARRATOR: Get smarter, faster, with videos from the world's biggest thinkers. To learn even more from the world's biggest thinkers, get Big Think+ for your business.