If No Brain Is Free Of Bias, What Can We Trust?

If no brain is free of bias, what can we trust? Which field’s views can we rely on?

1. Redoing 100 psychology studies found two-thirds didn’t replicate, causing much concern.

2. Meanwhile, Noah Smith matter-of-factly writes, “Traditionally, economists … put the facts in a subordinate role [to] theory. … Plausible-sounding theories are believed to be true unless proven false, while empirical facts are often dismissed.” Isn’t that worse than failed replication? A recipe for data-decorated faith?

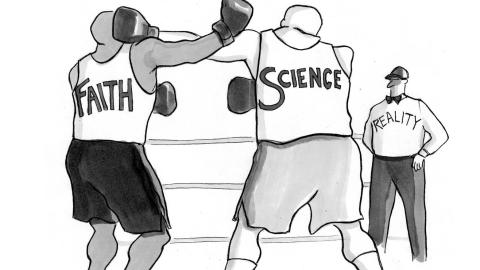

3. Smith calls economics “a rogue branch of applied math” that “evolved different scientific values.” But can “scientific” rightly apply where empirical facts don’t rule? Isn’t that utter non-science? Unless facts reign, what separates the sciences from superstition?

4. Real sciences permit only shakable faiths (see Science’s Toughest Test). Only bias-balancing processes are held sacred — not inputs or outputs, not cherished assumptions or results. That isn’t the game Smith describes. No one is immune to their beloved beliefs (or “identity-protective cognition”), but the sciences organize themselves to counter such biases — they’re reality refereed.

5. Perhaps these economic quibbles are minor? Apparently principles “are by no means universally agreed.” And faith in free-market economics rests on incomplete logic and near-utopian assumptions— in no real case can free markets do what’s preached. Maybe that’s OK… if in your game plausible theory-faith beats empirical facts. But in more trustworthy games, new facts must oust old certainties (e.g., redistribution ≠ less growth).

6. Smith hopes theory-free “Big Data” means that empirical economics will soon “dominate.” But economic data suffers high “causal density.” And its “gold standard” randomized clinical trials have limits. Meanwhile, key metrics like GDP don’t capture key distinctions. Plus, without changes in professional values or theory-beats-data practices, will economics be more trustworthy? Maybe economics is safer descriptively rather than prescriptively.

7. Economic historian Michael Lind says economics isn’t a natural science. However much physics-gas-like math it (ab)uses, economics can’t escape its history-like aspects.

8. How data works in history is different than in physics. In history, innovation happens. Patterns change. Yesterday’s impossibilities become today’s driving forces. Unlike behavior in physics, human behavior isn’t as safely generalizable. Nothing in physics chooses. Or changes how it chooses = in social sciences extrapolation is riskier (here’s a data journalism example). Perhaps market “laws” aren’t gravity-like.

9. Biases and flaws are like foreheads — it’s easier to see others’ than your own. Escaping our own biases requires tools. Before trusting experts, ask if their field is organized to challenge cherished assumptions. Is its game “reality refereed”? We should trust more in processes that rigorously balance biases, not in individuals. Confirmation bias haunts even geniuses.

10. Psychology’s ills are worrying, but economics’ beliefs are more dangerous. Markets enact our ethics, powerfully and globally. Do we want markets to make musical toilets while some starve?

11. We’re betting the planet on economic faiths (e.g., profit before planetary health). If cherry-picked data-doting free-market dogma doesn’t pan out, what’s our fallback?

In a world full of biases and risks, the wise guard against “theory-induced blindness.” And they contingency plan.

Illustration by Julia Suits, The New Yorker Cartoonist & author of The Extraordinary Catalog of Peculiar Inventions.