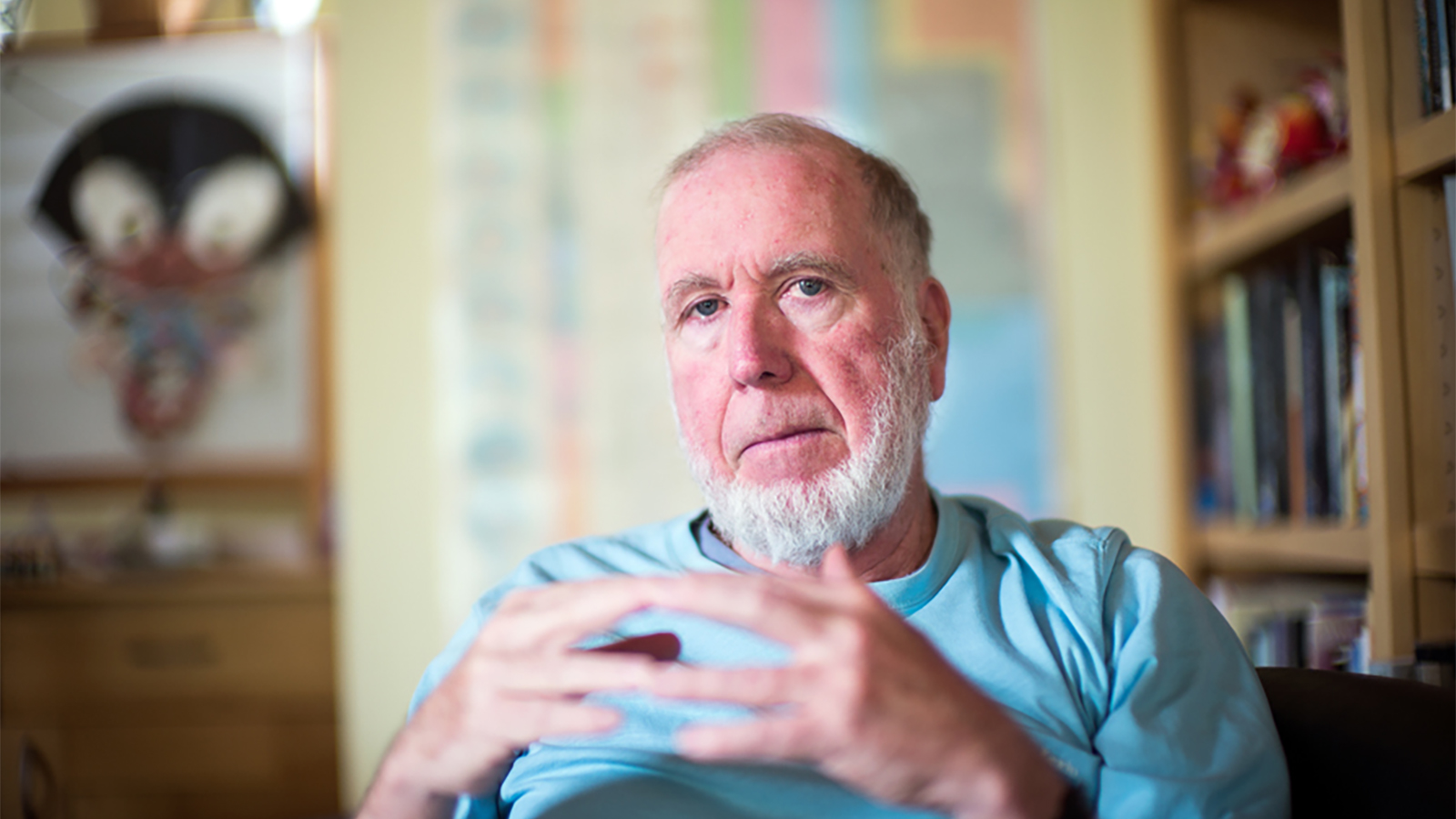

A leading venture capitalist, Vinod Khosla is the co-founder of Daisy Systems and founding Chief Executive Officer of Sun Microsystems. Khosla pioneered open systems and commercial RISC processors. He became[…]

Sign up for Big Think on Substack

The most surprising and impactful new stories delivered to your inbox every week, for free.

Sun Microsystems co-founder Vinod Khosla can’t imagine oil being more than $30 a barrel by 2030.

Tom Stewart: Vinod, let me ask you, you’re in the business, among other things, of radical disruption. You’ve been quoted as saying, last week I think, that coal could actually become the cleaner fuel than solar. And you said earlier today that the biggest thing that you think we need to do is to have economic gravity. Economic gravity always prevails and how can we start to get that gravitational pull to strengthen. So, how can we get that gravitational pull to strengthen so the people start moving?

Vinod Khosla: Thanks Peter. I’m a big believer that in the end, economic gravity always rules. And that environmentalists, by at large, trying to convert the rest of the world into environmentalists are going the wrong way. We need to take environmentalists and turn them into what I call “pragmentalists”. That understand the role of economics, economic gravity in large social adoption of new energy sources, technologies, everything else.

Having said that, I actually believe all the people, all the gurus, the experts, and we can talk about expert forecasts, they are probably almost always wrong and random. We can come back to that; there is statistical data to support it.

Peter Voser: I don’t need them, I believe you.

Vinod Khosla: But those of you who are interested read a book called, “Expert Political Judgment,” by Professor Tetlock, a 20-year study of 80,000 forecasts; a very rigorous study. But we start believing these 20, 30, and 50 year forecasts from experts. We need to abandon them and instead of exporting the past into these future forecasts, we need to invent that future. We will along with that future, I am on record saying, I can’t imagine oil being more than $30 a barrel by 2030. And the reason is very simple, it will have to compete it’s way down to compete with biofuels and cost of production of biofuels is the marginal cost of rent on land, and if you look at fundamental economics, that’s the number it will drive to in real terms, real dollars. There is no question in my mind that we will have technologies that meet unsubsidized market comparativeness against fossil fuels that are 100 percent renewable. Maybe better than 100 percent, which is where my comment where coal can in fact be cleaner than solar. That’s based on the technology we feel is waiting for commercialization that reduces the lifecycle of carbon production of power generation from coal to more than 100 percent. So, solar can only do 100 percent reduction in carbon emissions, this technology, by displacing products that could otherwise produce carbon can get up to 200 percent reduction.

I’ll be happy to go into it in more detail, but the main point is this. We have to bet on innovation and technology. And technology that’s radical and different and get our best talent working on this technology. And I would submit that five years ago, there wasn’t a PhD student at MIT or Cal Tech, or Stanford, at least that I knew of, that was interested in working on energy recent. All the best minds went to biotechnology, nanotechnology, computer science, semi-conductor devices, not in energy research. And that has changed, and that’s why the future will be different and why innovation will reach this point of unsubsidized market competitiveness. Because of that, I use my favorite phrase, these technologies will meet Chindia price; the price at which India and China will adapt them without regulation. I believe we are far closer to that point than anybody realizes.

Tom Stewart: Bureaucratic survival. Never put a date in the same sentence. So, you’re not a bureaucrat, so I’m going to ask you to break that rule. You said these technologies will meet the Chindia price, when?

Vinod Khosla: So, I believe carbon sequestration today for many carbon point emitters, many coal plants. I’m not saying most, I’m not saying all. Many coal sources can be carbon negative, or carbon zero, in the next year or two without a price on carbon because they turn carbon dioxide in this case into useful building products that can be sold. And so carbon become, not a problem, but a feed stock. In the case of oil, I would say the same thing. I believe in the next year or so, renewable oil sources can compete unsubsidized with crude oil. I also believe –

Tom Stewart: The biofuels and things like that –

Vinod Khosla: Biofuels, right. I also believe on the consumption side of this, unlike and I wrote a blog that got me in a lot of trouble where I wrote a blog about two years ago, which said, “Prius is more green wash than green.” And it is more green wash than green. It is a completely uneconomic technology and in the McKenzie study came out, hybridization of cause came out as the single most expensive way to reduce carbon in dollars of costs per ton of carbon reduced. I believe it was about $100 per ton. And so we are picking technologies because the environmentalists love them, that is pleasing to the political appetite and certain political communities, and that’s the wrong way to go.

On the efficiency side. We’re working on engines that can have 50% more efficiency without an increase in costs of internal combustion engines. And I believe those are near commercial today. It’s pretty easy to do a light bulb. LED light bulb, and we will be introducing that within the next year, that’s cheap enough, that means below $10, where it pays for itself within the first 12 months.

Tom Stewart: You’re saying it’s across three of the four technologies you actually said within the next year or 18 months, we reach a tipping point, and the fourth you didn’t –

Vinod Khosla: I would say all four will be commercial next year at retail, and I’ll add a fifth which is a major energy consumer, I think air conditioning that is cheaper than today’s air conditioning and 75 percent less energy consumption. That’s most of the consumption, lighting, HVAC, transportation fuels.

Vinod Khosla: Thanks Peter. I’m a big believer that in the end, economic gravity always rules. And that environmentalists, by at large, trying to convert the rest of the world into environmentalists are going the wrong way. We need to take environmentalists and turn them into what I call “pragmentalists”. That understand the role of economics, economic gravity in large social adoption of new energy sources, technologies, everything else.

Having said that, I actually believe all the people, all the gurus, the experts, and we can talk about expert forecasts, they are probably almost always wrong and random. We can come back to that; there is statistical data to support it.

Peter Voser: I don’t need them, I believe you.

Vinod Khosla: But those of you who are interested read a book called, “Expert Political Judgment,” by Professor Tetlock, a 20-year study of 80,000 forecasts; a very rigorous study. But we start believing these 20, 30, and 50 year forecasts from experts. We need to abandon them and instead of exporting the past into these future forecasts, we need to invent that future. We will along with that future, I am on record saying, I can’t imagine oil being more than $30 a barrel by 2030. And the reason is very simple, it will have to compete it’s way down to compete with biofuels and cost of production of biofuels is the marginal cost of rent on land, and if you look at fundamental economics, that’s the number it will drive to in real terms, real dollars. There is no question in my mind that we will have technologies that meet unsubsidized market comparativeness against fossil fuels that are 100 percent renewable. Maybe better than 100 percent, which is where my comment where coal can in fact be cleaner than solar. That’s based on the technology we feel is waiting for commercialization that reduces the lifecycle of carbon production of power generation from coal to more than 100 percent. So, solar can only do 100 percent reduction in carbon emissions, this technology, by displacing products that could otherwise produce carbon can get up to 200 percent reduction.

I’ll be happy to go into it in more detail, but the main point is this. We have to bet on innovation and technology. And technology that’s radical and different and get our best talent working on this technology. And I would submit that five years ago, there wasn’t a PhD student at MIT or Cal Tech, or Stanford, at least that I knew of, that was interested in working on energy recent. All the best minds went to biotechnology, nanotechnology, computer science, semi-conductor devices, not in energy research. And that has changed, and that’s why the future will be different and why innovation will reach this point of unsubsidized market competitiveness. Because of that, I use my favorite phrase, these technologies will meet Chindia price; the price at which India and China will adapt them without regulation. I believe we are far closer to that point than anybody realizes.

Tom Stewart: Bureaucratic survival. Never put a date in the same sentence. So, you’re not a bureaucrat, so I’m going to ask you to break that rule. You said these technologies will meet the Chindia price, when?

Vinod Khosla: So, I believe carbon sequestration today for many carbon point emitters, many coal plants. I’m not saying most, I’m not saying all. Many coal sources can be carbon negative, or carbon zero, in the next year or two without a price on carbon because they turn carbon dioxide in this case into useful building products that can be sold. And so carbon become, not a problem, but a feed stock. In the case of oil, I would say the same thing. I believe in the next year or so, renewable oil sources can compete unsubsidized with crude oil. I also believe –

Tom Stewart: The biofuels and things like that –

Vinod Khosla: Biofuels, right. I also believe on the consumption side of this, unlike and I wrote a blog that got me in a lot of trouble where I wrote a blog about two years ago, which said, “Prius is more green wash than green.” And it is more green wash than green. It is a completely uneconomic technology and in the McKenzie study came out, hybridization of cause came out as the single most expensive way to reduce carbon in dollars of costs per ton of carbon reduced. I believe it was about $100 per ton. And so we are picking technologies because the environmentalists love them, that is pleasing to the political appetite and certain political communities, and that’s the wrong way to go.

On the efficiency side. We’re working on engines that can have 50% more efficiency without an increase in costs of internal combustion engines. And I believe those are near commercial today. It’s pretty easy to do a light bulb. LED light bulb, and we will be introducing that within the next year, that’s cheap enough, that means below $10, where it pays for itself within the first 12 months.

Tom Stewart: You’re saying it’s across three of the four technologies you actually said within the next year or 18 months, we reach a tipping point, and the fourth you didn’t –

Vinod Khosla: I would say all four will be commercial next year at retail, and I’ll add a fifth which is a major energy consumer, I think air conditioning that is cheaper than today’s air conditioning and 75 percent less energy consumption. That’s most of the consumption, lighting, HVAC, transportation fuels.

Recorded on March 26, 2010

▸

12 min

—

with