Michael Lewis on the interconnectedness of the global economy.

Question: What can we learn from the Russian-Asian Slump?

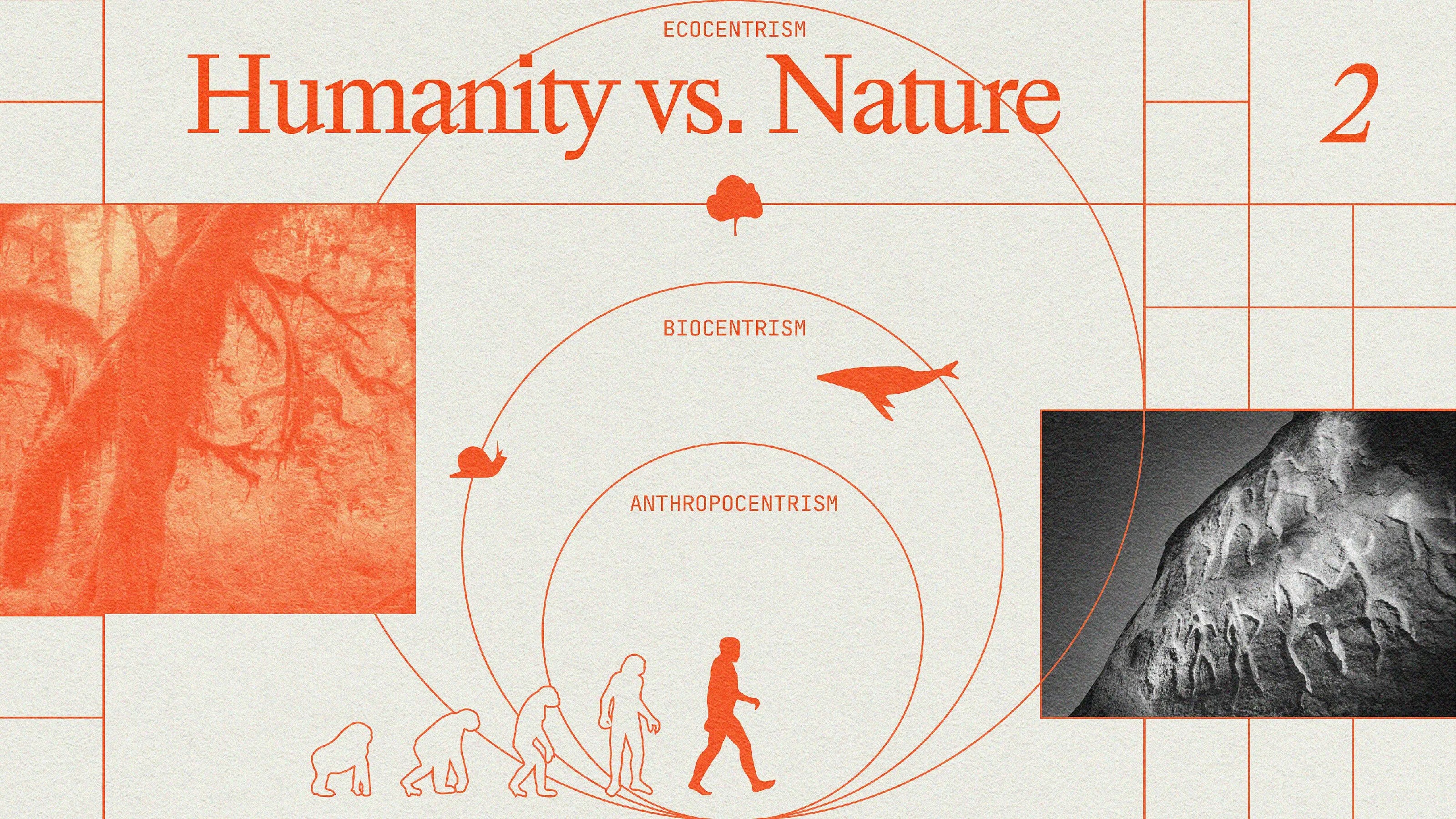

Lewis: Well, again, it’s a complicated story but basically what happened was there was excessive faith in the Southeast Asian economies to generate wealth, capital, which has been more and more mobile capital every year/ around the world. And there was a lot of mobile capital in the late ‘90s that flooded into Southeast Asia and was misused. They had essentially crony capitalism and in a funny way squandered it in a way that’s so similar, sort of vaguely reminiscent of the subprime mortgage lending. So the people from the outside world kind of flooding in with a kind of a blind faith, and when the faith is blind, the panic is also blind. I mean, the minute that there was a kind of an awareness that, “Oops, this isn’t working out like we hoped it would work out in Southeast Asia.” There was a run on the bank. It essentially ran out except the bank was a country, and the country was Thailand and South Korea, and so on. Then what happened was interesting because it is an analogy, actually there is an analogy between what’s going on today. When one black box proves to be explosive, when this one financial black box into which people are putting money, they don’t completely understand what’s going on in there but they think, “Oh, well, it’s going to work out.” And it doesn’t work out, and it doesn’t work out for reasons they didn’t see coming. What the markets do is they doubt all black boxes. They start looking for the other black boxes that they put money into that, oh, my God, maybe those are wrong, too. And this is what happened in that case because the crisis jumped from Southeast Asia to Russia. And as a newspaper reader, we’ll be looking at the newspaper one day and Southeast Asian countries are, you know, bankrupt. And then all of a sudden, you’re reading that Russia may not pay off its debt. Well, what’s the connection there? And the connection is investors were fleeing Russia because they thought maybe we shouldn’t put money in there either. And then you’re reading the next day that there’s this gazillion-dollar, trillion-dollar hedge fund. It’s a multibillion dollar hedge fund with trillion dollars of positions called Long-Term Capital Management in Greenwich, Connecticut that is collapsed, exposing all of Wall Street to unsustainable losses. Because of this, and you think, how did that happen? All right, so the lessons are: the danger of black boxes, generally. People putting money into things they don’t actually completely understand and how much of that goes on, quite a bit of that goes on. And their preceding panics, there are irrational enthusiasms for, say, Southeast Asia. And then, the second big lesson is the [interconnectiveness] of everything. It’s sort of the butterfly flapping its wings one end of the world causing hurricanes or whatever. Butterfly wings do these days, [nocturnal] butterfly wings. That you start with crony capitalism being misunderstood in Southeast Asia and you end with a total, freaking crisis on Wall Street. And that’s the beginning of the world we’re in now. It’s not the beginning but it’s a marking point. And we’re even more interdependent financially than we were then. There is this sort of a very loose, poetic analogy between what’s going on in the financial world and what’s going on in the environment that a growing realization that our fates are all intertwined, with the idea that you can isolate your problems, that you can wall yourself off is really a false idea.