How do you make better decisions in high-risk situations? Be in tune with your body.

If you don’t make decisions by “going with your gut,” you may want to start now.

Why? According to research published in Scientific Reportsin 2016, researchers from the University of Cambridge and Sussex discovered that the more aware of your “gut feelings” you are, the more accurately you’ll make high-risk decisions.

First of all, “gut feelings” are interoceptive sensations that guide behavior. Rather than gathering data and making decisions about the outside world with our senses, interoceptive sensations gather data and make decisions about our bodies. They “can report anything from body temperature to breathlessness, racing heart, fullness from the gut, bladder and bowel,” and “they underpin states such as hunger, thirst, pain, and anxiety,” according toScience Daily. Neurobiologist Antonio Damasio explains the whole thing to us here:

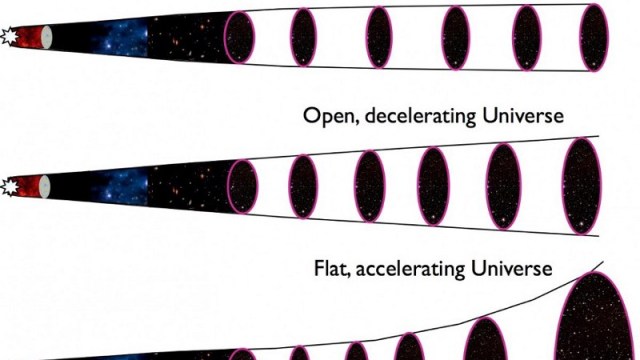

It’s that last ability of interoceptive sensations that makes them useful in high-risk decision making. Research shows that high-risk choices are accompanied by subtle physiological changes like a faster heartbeat. Those physiological changes are known as somatic markers, and “such autonomic responses feedback on the brain to bias our decisions, steering us away from gambles with negative expected returns and towards ones with positive returns,” as the study reports.

London researchers decided to test that theory with the most high-risk decision makers they could find: hedge fund traders. The team gathered 18 high-frequency male traders and tested their ability to silently count their own heartbeats without touching their chests or pulses. The team measured the traders’ results against a control group of 48 male students. The traders “performed significantly better… the mean score for traders was 78.2, compared to 66.9 for the controls,” the study reports.

Stronger still, the most accurate traders were the ones with the most job experience in high-frequency trading. In many cases, a trader’s heartbeat counting score indicated the number of years he had survived as a trader.

“Traders in the financial world often speak of the importance of gut feelings for choosing profitable trades — they select from a range of possible trades the one that just ‘feels right,'” says John Coates, study co-author and former Wall Street trader. “Our findings suggest they’re right — they manage to read real and valuable physiological trading signals, even if they are unaware they are doing so.”

While those findings are striking, they also confirm a long-held secret of the stock market: it’s driven by emotion, not logic. “Stock traders make decisions based on psychological factors, including emotions, and may place undue weight on specific information at the expense of other relevant data,” explains Psychology Today. “Different emotional states can have unpredictable effects on decision-making at different times. Mood can have an impact on cognitive performance and expectations, while factors such as a series of gains or losses can have an effect on traders.”

A 2002 study published in theJournal of Cognitive Neuroscience monitored the heart rate, blood pressure, and sweat production of 10 professional traders during their normal work day. While the team measured the traders, they also collected real-time financial information, recording the prices and trends of “13 foreign currencies and two stock futures that the traders were eyeing and manipulating,” the study reports. They found that “even veteran traders with a reputation for logical cold decisions had heart palpitations during volatile events, and less experienced traders reacted emotionally to a broader swath of market behavior,” the study reports. Essentially, stock market trades are made based on how the traders react to the data, not because of the data itself.

That said, there are caveats with the Cambridge study. Financial traders are really good at reading their heartbeats compared to most people because they’ve got lots of practice at it; other people who regularly make high-risk decisions, such as police or firefighters, might be equally as good. Furthermore, other research has shown that heartbeat detection ability increases with stress levels regardless of occupation. All the Cambridge study demonstrates for certain is a correlation between heartbeat detection accuracy and accurate high-risk decision making; it does not show causation. “It’s a starting point for more controlled science,” Coates admitted to the New York Times. “There’s a part of our brain that sends signals to our body, and it’s really smart. It doesn’t succumb to the mistakes of behavioral finance.”

Add to that the fact that the study was only done on men and I see another immediate avenue for testing. I couldn’t find any research comparing women’s stress levels to men for this kind of test and I’m curious as to how that would have affected the correlation factor. I would also have liked to see the traders measured against men their own age who might have similar experience making high-risk decisions rather than undergraduate students to get a more accurate read on the heartbeat detection ability.

Still: there is enough research out there to safely say that you shouldn’t use cold, hard Spock logic to make high-risk decisions. Poker player and former trader Brandon Adams backs it up and explains why here: