Three Ways to Strike It Rich

This post is not a scam, I assure you. You’ll find three (very different) paths to riches outlined below. But to appreciate my advice, I need to depress you a little first.

Start with these data points. About 5 percent of Americans already consider themselves rich, and the top 5 percent of earners in the United States make $232,000 an up a year. Find yourself on the curve (notice, by the way, that if your family brings in more than $66,000 a year, you’re in the top half of the distribution):

While there are poverty guidelines issued by the U.S. Department of Health and Human Services, the government does not officially lay out what it considers “rich” to mean. Given this definitional lacuna, it seems reasonable to adopt a meaning that springs from the way average people understand the term. Drawing on our two bits of data, that means an annual income upwards of $200,000 is the dividing line between the rich and, well, the not-so-rich.

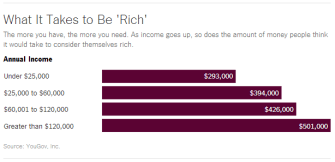

As it happens, though, when you ask people directly what level of annual income is necessary to reach the heights of the rich, they aim higher than this figure. A lot higher. And the more money they make, the more annual income they think is required to qualify as rich. This graphic from the New York Times, based on a study by political scientist Lynn Vavreck, shows how the answers vary:

People under the poverty line say they need a paycheck of $293,000 before they would consider themselves rich, while people we ordinarily think of as “middle class”—families earning between $60,000 and $120,000—think they’ll be rich only after they leave 99 percent of Americans in their dust. How many of those middle-incomers will ever ascend to those heights? And look at Americans earning over $120,000 a year; for them, riches come only once you earn half a million dollars a year.

So here is what is depressing. The average American believes that “rich” is an adjective applying to somewhere between the top 5 percent and the top fraction of 1 percent of earners. That’s not a lot of people. And as they walk farther down the income corridor, seeing their take-home pay rise, the target, the objective, recedes into the distance. For all but the filthy rich, the goal of becoming rich looks pretty unattainable.

This is where we come to the advice section of the post. How, given this tendency toward relentless, fruitless striving, can Americans reach their financial goals? A few ways. I present them increasing order of plausibility.

1. Work really hard, get really lucky, or both, and worm your way into the 1 percent.

People do. You could too. But your chances aren’t great of reaching quite that high on the economic scale. Maybe try something else.

2. Don’t live near or hang out with people who are richer than you are.

The conventional wisdom that it’s better to buy a modest house in a great neighborhood rather than a McMansion in a lousy one might be good real-estate advice, but for most of us, it’s a recipe for resentment and a subjective feeling of being poor. This the sociological concept of “relative deprivation”—the feeling of being deprived, no matter your absolute prosperity level, when comparing your situation with that of your associates.

Karl Marx explains the idea with this example:

A house may be large or small; as long as the neighboring houses are likewise small, it satisfies all social requirement for a residence. But let there arise next to the little house a palace, and the little house shrinks to a hut. The little house now makes it clear that its inmate has no social position at all to maintain, or but a very insignificant one; and however high it may shoot up in the course of civilization, if the neighboring palace rises in equal of even in greater measure, the occupant of the relatively little house will always find himself more uncomfortable, more dissatisfied, more cramped within his four walls.

This strategy may well work, but it comes at significant cost. It limits your social acquaintances and possible residences, of course, and relegates you to a relatively narrow life of lording your comparative wealth over others. So unless you live around and socialize with people who are a perfect economic match for you, your friendships may be marred by resentment from the other direction. That’s no good. But we have a third possibility to achieve your dreams.

3. Rethink your values; redefine “rich.”

I don’t mean to get preachy here, but this will sound slightly moralistic. So be it. If you clicked on the link to this post, it’s probably because you want to strike it rich. If you’ve read this far into the post, you see how long the odds are against that goal, how the pursuit is like an itch that can seldom be scratched, and how an obsession with your wealth vis-a-vis your neighbors and friends will, more often than not, depress you.

Time for a tiny dose of ancient teaching. A Jewish collection of wisdom known as Ethics of the Fathers (Pirke Avot) contains this nugget from Ben Zoma:

“Who is rich? One who is satisfied with his lot.”

For the truly impoverished who have neither shelter nor food, satisfaction with one’s lot would be possible only while under a serious delusion. But for the rest of us who are secure in our homes and do not go to bed hungry, who live in countries with basic rights and decent governments, it’s not bad advice. This is not a call for complacency or shiftlessness. It is not a plea to give up on yourself or abandon plans for enriching your life. Rather, it’s an observation that whoever you are and however much you have, happiness comes from satisfaction with that bundle of goods, at that moment in time. Appreciating what you have rather than forever longing for more may be the least flawed recipe on offer for living a rich life.

Image credit: Shutterstock