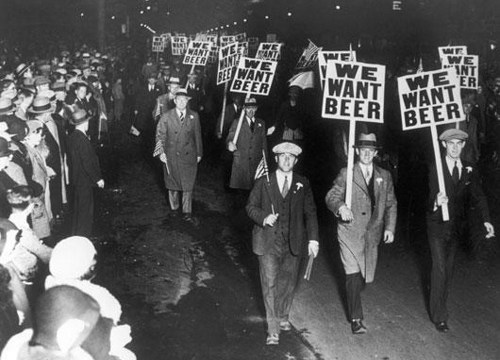

Americans Are Living on the Edge

Earlier this week, Yves Smith at Naked Capitalism flagged a disturbing finding from a September survey of U.S. households. The survey, which was conducted by a consortium of financial planning industry groups in conjunction with the U.S. Conference of Mayors, found that one-third of Americans would not be able to make their rent or mortgage payments for more than a month if they lost their job.

Even relatively wealthy Americans are living close to the edge. The survey found that 10% of those earning more than $100,000 would miss a rent or mortgage payment if they lost their job. The study also found that less than 40% of Americans could make payments for more than 5 months. That doesn’t quite mean that if they lost their jobs they would be homeless, since many would be able to move into smaller homes or live with family. But it does show how little savings many Americans have and how difficult it is for them to maintain their standard of living. Three years since the start of the recession, it shows how close to the edge many Americans are still living.

Of course, one of the main reasons Americans default on their homes is because they’ve lost their jobs. With unemployment holding steady at more than 9%—yesterday’s jobs report showed the economy is barely adding enough jobs to keep up with the growth of the workforce—the labor market is still weak. The collapse of the housing bubble and high credit card debt mean that many Americans don’t have much in the way of savings. So it shouldn’t be surprising that the foreclosure rate is still high and first-time default notices actually rose in August.

Craig Pollack and Julia Lynch—who happens to be an old friend of mine—argue in The New York Times this week that the wave of foreclosures amounts to a literal health crisis. Research shows Americans who lose their homes have a harder time taking care of their health and disproportionately suffer from diabetes, heart disease, and depression. It’s ongoing disaster, and one which is only likely to get worse. With the eurozone crisis looming, the recent household survey shows how precarious the financial situation of ordinary Americans is—as well as just how fragile the American economy itself is.

Photo: Jeff Turner